Yield Yak Introduces DeltaPrime Savings Accounts

Yield Yak has been a longstanding supporter and partner of DeltaPrime, with DeltaPrime integrating Yak Swap for in-app swaps and adding auto-compounding strategies for Prime Account users on Avalanche and Arbitrum. Today marks the next step in their collaboration with the integration of DeltaPrime Savings Account Pools on Yield Yak.

TLDR:

- DeltaPrime Savings Accounts are high-performing 'real yield' pools which have the ability to super-charge the Avalanche and Arbitrum DeFi ecosystems

- Introduction of these high-yielding pools aims to increase their visibility

- Allow users to benefit from Yield Yak's familiar method of tracking historical returns vs projected

- No fees for depositing via Yield Yak

What benefits does this bring?

There are a number of key positives that come from this initiative, the first being that it increases the visibility and accessibility of the DeltaPrime Savings Pools across both the Avalanche and Arbitrum ecosystems, making the pools available to all Yield Yak users directly within the platform.

The Savings Pools are attractive to depositors as they offer high yields across a range of blue chip assets on both blockchains, and only require single-sided deposits so are not exposed to impermanent loss.

The increased exposure of the Savings Pools should bring more liquidity to DeltaPrime, which then becomes available for Prime Account users to put to work across the diverse selection of integrated protocols within their accounts, whilst paying lower borrowing fees when the supply on the Savings side increases.

This has the added benefit of increasing the liquidity available on multiple protocols throughout the ecosystems, all from a single deposit in the Savings Pools. Those trading through the pools this liquidity ends up in also receive the benefit of deeper liquidity, optimising price execution and reducing slippage on their swaps. Increased liquidity in DeltaPrime Savings Accounts is a win/win for the entire ecosystem.

Why should I deposit with Yield Yak?

The Savings Pools on Yield Yak are simple proxies to DeltaPrime, and charge no fees for their use whatsoever, including no deposit, withdrawal or performance fees. This means that it is equivalent to depositing directly on DeltaPrime, but with some added benefits:

- APY calculations based on actual and recent performance

- Whilst DeltaPrime uses a forward looking calculation for their APR, Yield Yak bases APY calculations on returns realised from deposits to the pools.

- Advanced reporting available through Yield Yak Analytics

- This allows you to track and monitor things such as the TVL and APY of the pools over time, rather than just the current status.

- Simplified portfolio and position management

- If you have existing deposits with Yield Yak then you can now use and manage your positions in the DeltaPrime Savings Pools all from the same place, rather than having to switch between platforms.

- No fees whatsoever are charged

- Yield Yak usually charges a small performance fee on the yield in most pools, however the DeltaPrime Savings Pools have no deposit, withdrawal or performance fees at all.

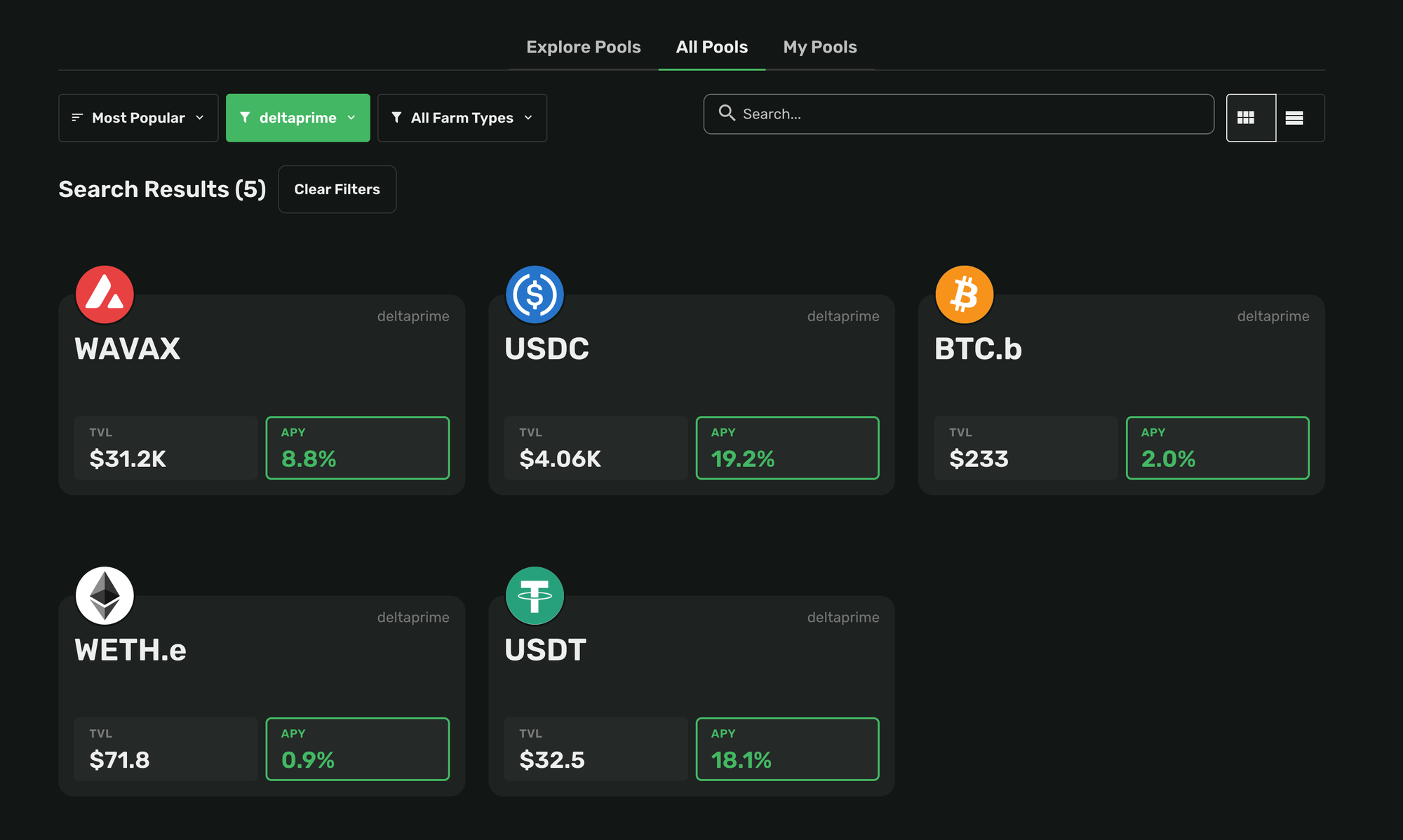

Which DeltaPrime Savings Pools are available?

Yield Yak now has the following pools available on Avalanche:

- WAVAX

- USDC

- USDT

- BTC.b

- WETH.e

Arbitrum:

- WETH

- USDC

- DAI

- ARB

- WBTC

For more information about DeltaPrime Savings Account, you can read their Documentation or join their growing community on Discord.