Earning Big on AVAX, sAVAX and ggAVAX with Wombat and Yield Yak

Yield Yak launches boosted Wombat LST pools with some of the highest yields on Avalanche

Yield Yak are boosting rewards for sAVAX and ggAVAX Wombat Pools, and resident DeFi strategist harry.avax is here to break it down for you from every angle.

Introduction

This article may be the 25th in my Earning AVAX with AVAX series, but it's the first published on the Yield Yak Content Hub! Going forward, any new articles or reviews utilising Yield Yak will be shared here as well.

The main focus today is on Wombat, who launched on Avalanche in October of last year. I'll be expanding on the recently announcement partnership between Yield Yak and Wombat, which has resulted in the creation of four significantly boosted earning opportunities:

- One option for $sAVAX

- One option for $ggAVAX

- Two options for $AVAX

I'll be walking step by step through each, but they all work by providing single sided liquidity on Wombat and then making use of Yield Yak to automatically compound the rewards received for doing so.

As well as the magic of compound interest, this has the added benefit of earning a much higher rate of rewards due to the sizeable $veWOM position taken by the Yield Yak Treasury, which they've locked to maximise yields for depositors.

Wombat and Yield Yak

Wombat launched on Avalanche with both cross-chain stablecoin pools and their first pool for liquid staking tokens (LSTs), which is made up of $AVAX paired with $sAVAX, the LST issued by BENQI.

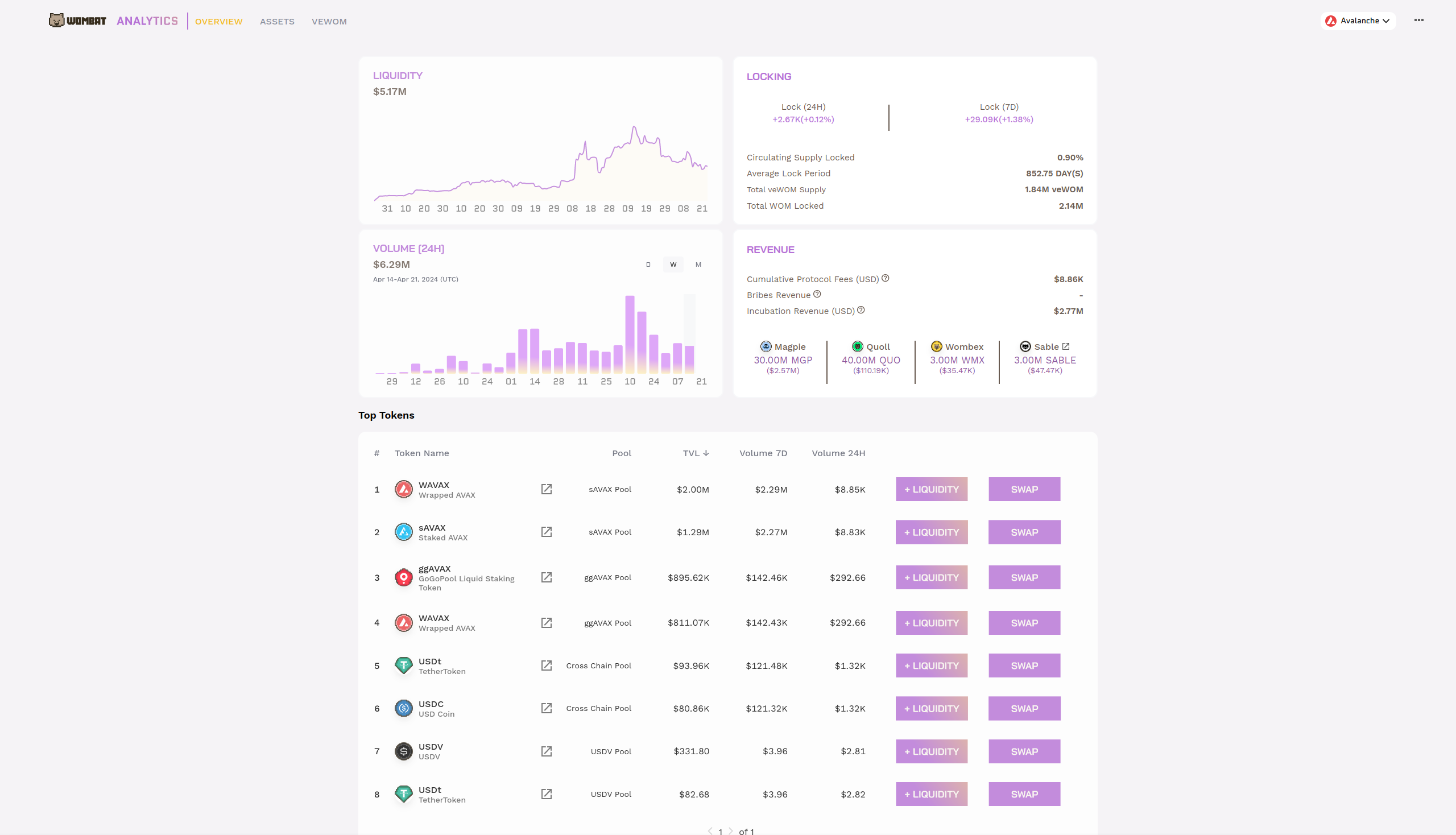

Both pools quickly garnered depositors, hitting over $1m in liquidity in just a few weeks and continuing to grow since, reaching a TVL of >$5m today. A large contributor to this are the generous $WOM rewards for depositors offered by Wombat themselves, with another being the support from their partners.

For BENQI, this comes in the form of additional $QI rewards for those providing liquidity to the $sAVAX pool, with the combination of both tokens and swap fees bringing the base yields to incredibly attractive levels.

Following the success of their first LST pool, Wombat added their second in January of this year, pairing $AVAX with $ggAVAX this time. This expanded their coverage of the liquid staking ecosystem on Avalanche to the two largest LSTs by market-cap.

In a similar manner to BENQI, additional $GGP rewards have also been provided by GoGoPool for depositors to the $ggAVAX pool. This again makes it a very appealing option for liquidity providers, and has resulted in some excellent yields.

One of my personal favourite aspects is the availability of single sided deposits, allowing you to add either your LST of choice or $AVAX instead, or you can add both by depositing to each side if preferred, more akin to traditional LPs.

The design clearly appeals to traders as well, with Wombat consistently facilitating excellent volume through the available pools, particularly when considering that there are so few pairs in comparison to most other exchanges on the chain. I think that this highlights just how effective the swap and pricing mechanisms are.

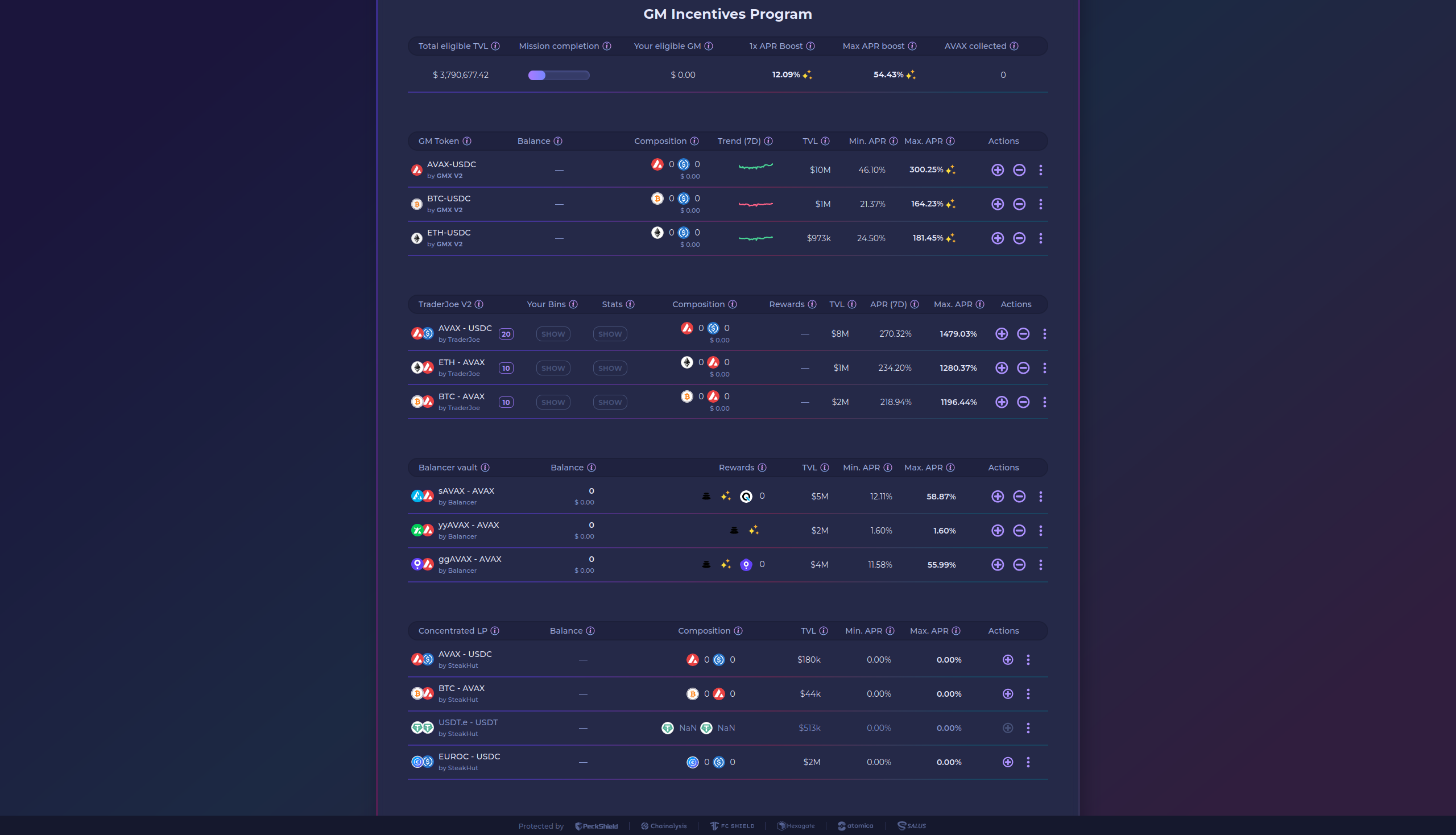

This becomes even more apparent when reviewing the figures through an aggregator, such as those from Yak Swap as in the screenshot above. Wombat ranks 4th in volume over the last 30 days, with a total of $2.9m in swaps routed through them. The figures that stand out are the volumes for $sAVAX and $ggAVAX on Yak Swap, with a combined total of ~$5.8m between the two. The volume routed through Wombat is around half that, meaning it could account for up 50% of all trades of the two.

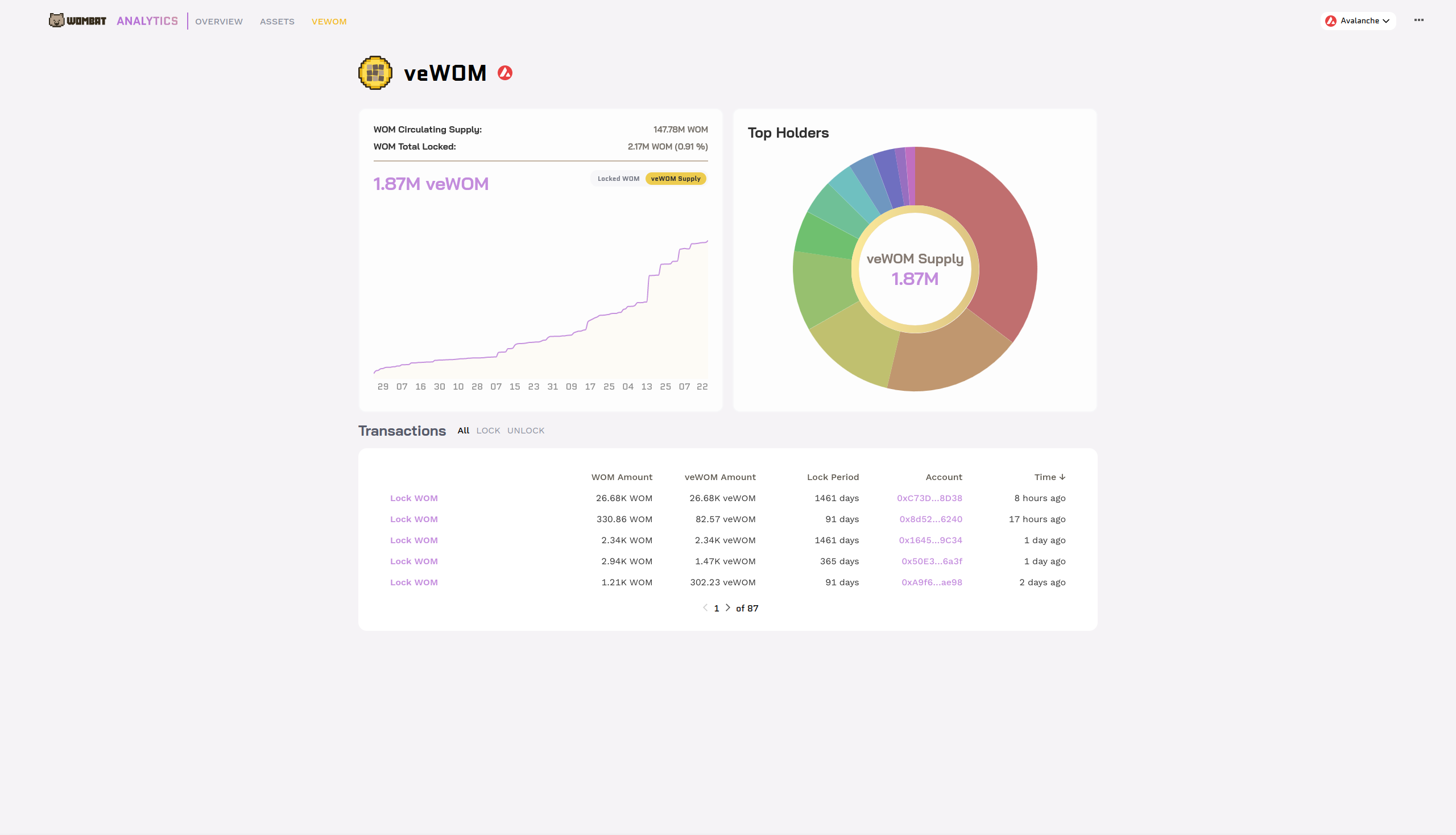

Continuing in the spirit of collaboration stemming from the Yak Swap integration, the partnership between Wombat and Yield Yak was announced towards the end of February. This included a strategic purchase of 344,827 WOM by the Yield Yak Treasury, which was then locked for the maximum length of 4 years to earn the largest amount of $veWOM possible.

The mechanics behind it are fairly involved so I won't try to explain it all here, as it would take an entire article by itself. Thankfully, one such article has already been written by the Wombat team and can be found in the link above. I'd highly recommend giving it a read if you'd like to understand exactly how it works.

In very simple terms, it means that Yield Yak can use the $veWOM balance to boost the rewards earned on deposits to specific pools on Wombat, and has done exactly that for the four that I'll be entering today. These pools not only receive an increased rate of rewards, but those earned are automatically compounded into more of the underlying assets and added to the LP, growing your position over time.

With the boost provided by the new Yield Yak pools, you are able to earn at a faster rate than is available directly without having to buy and lock any $WOM yourself, and no interaction is required to handle the rewards, thanks to the wonder that is compounding. All of this makes for my favourite kind of "hands off" strategy.

Wallets

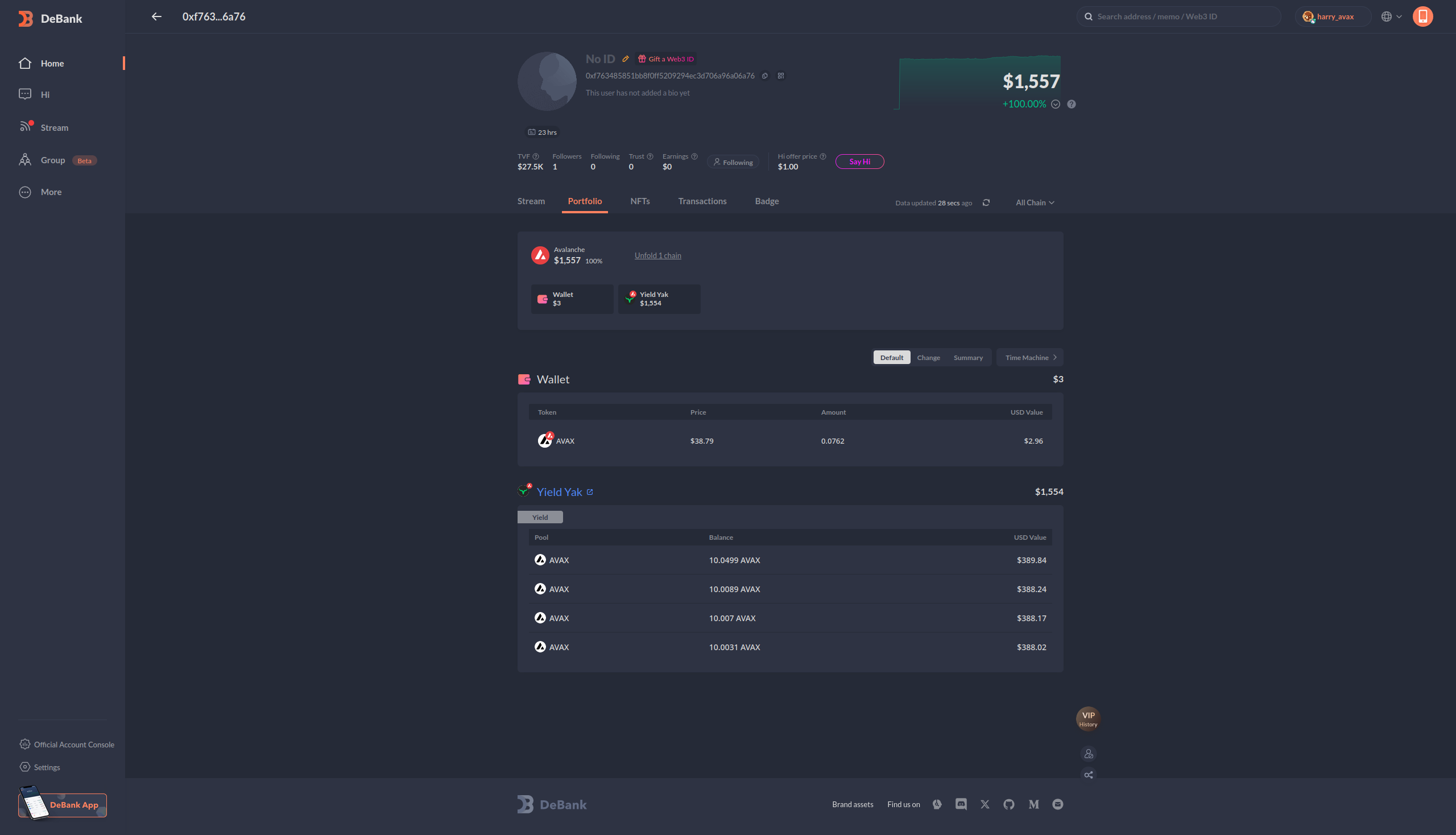

I set up a new wallet with the following address for use with this strategy:

- 0xF763485851bb8f0FF5209294EC3D706a96A06A76

Which you can track, follow and verify on DeBank, SnowTrace and SnowScan:

Next, I sent 40.25 AVAX to this address, with 40 AVAX to be allocated as follows:

- 10 AVAX for the $AVAX side of the $sAVAX pool.

- 10 AVAX to be exchanged for $sAVAX for the $sAVAX side of the $sAVAX pool.

- 10 AVAX for the $AVAX side of the $ggAVAX pool.

- 10 AVAX to be exchanged for $ggAVAX for the $ggAVAX side of the $ggAVAX pool.

Leaving the remaining 0.25 AVAX for gas fees.

Obtaining $sAVAX and $ggAVAX

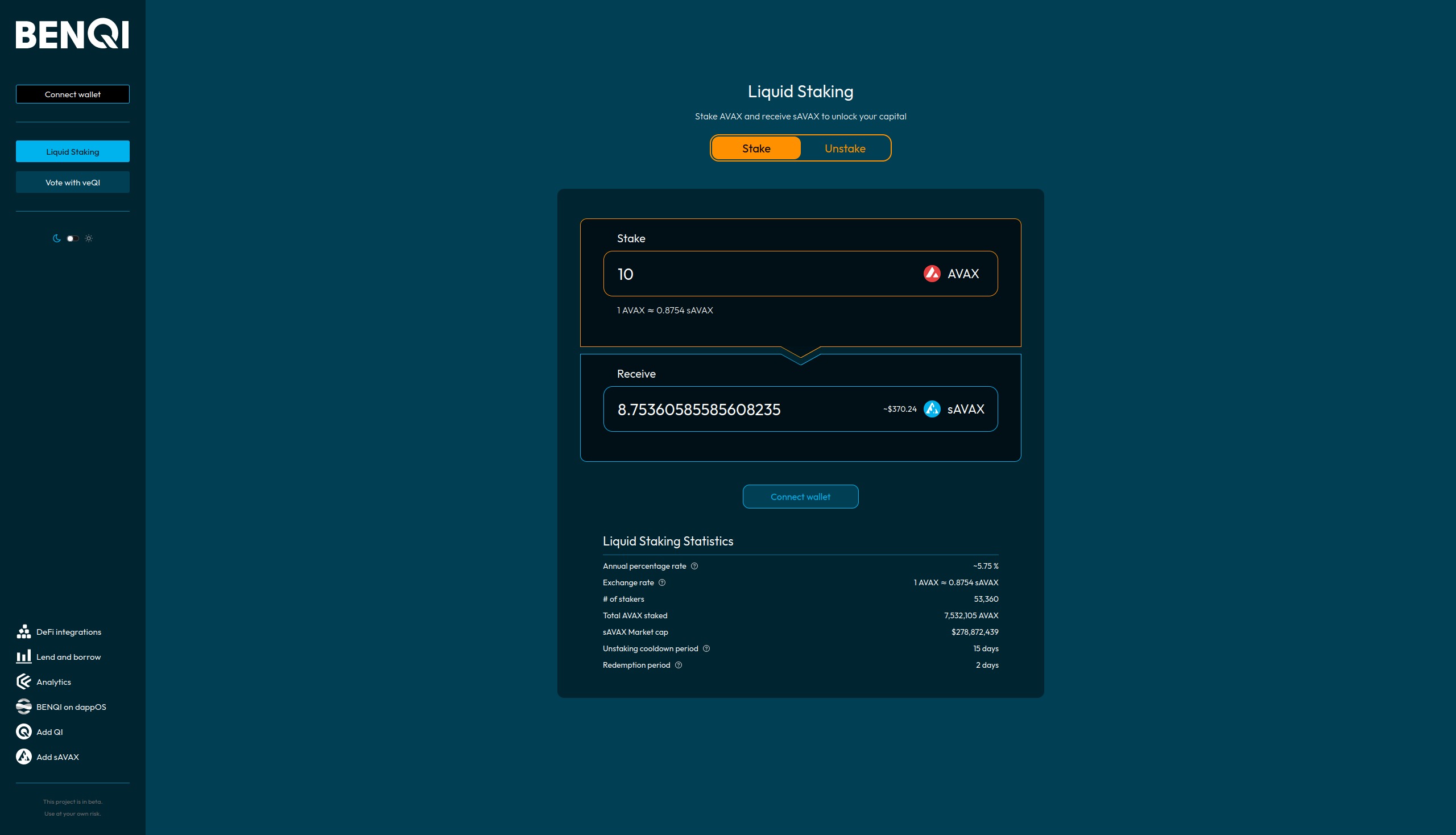

Before heading to Wombat, I first had to acquire some $sAVAX and $ggAVAX for the respective side of each pool. You can stake your $AVAX directly with BENQI and receive $sAVAX in return for doing so, as in the screenshot above.

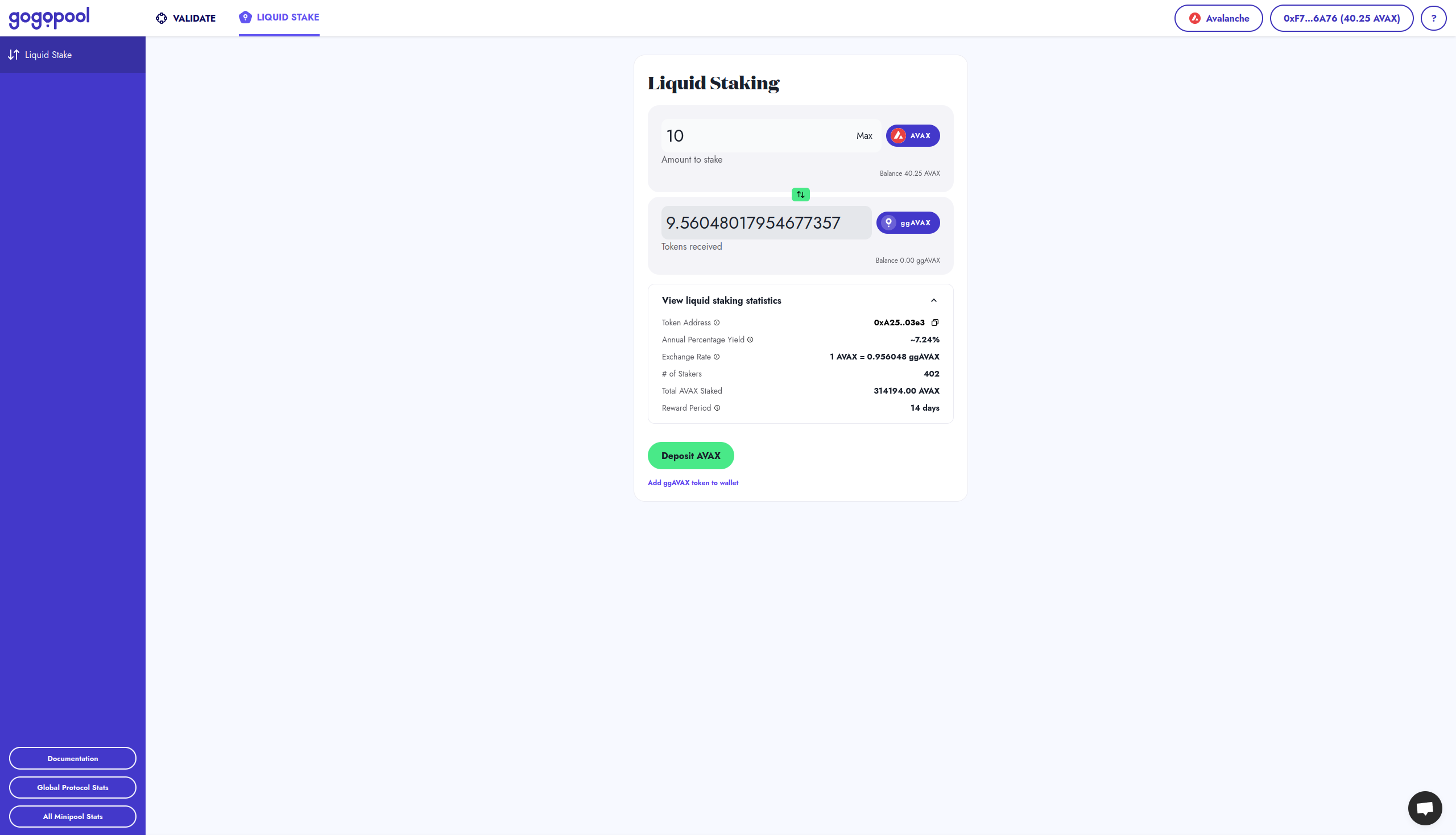

You can also do this with GoGoPool, receiving $ggAVAX for staking your $AVAX with them. These can be good options when dealing with much larger amounts, as it ensures that you receive the exact exchange rate at the time. However it's always worth checking exchanges that the LSTs available on or using a DEX aggregator to do the checking for you, as you can often find a better rate.

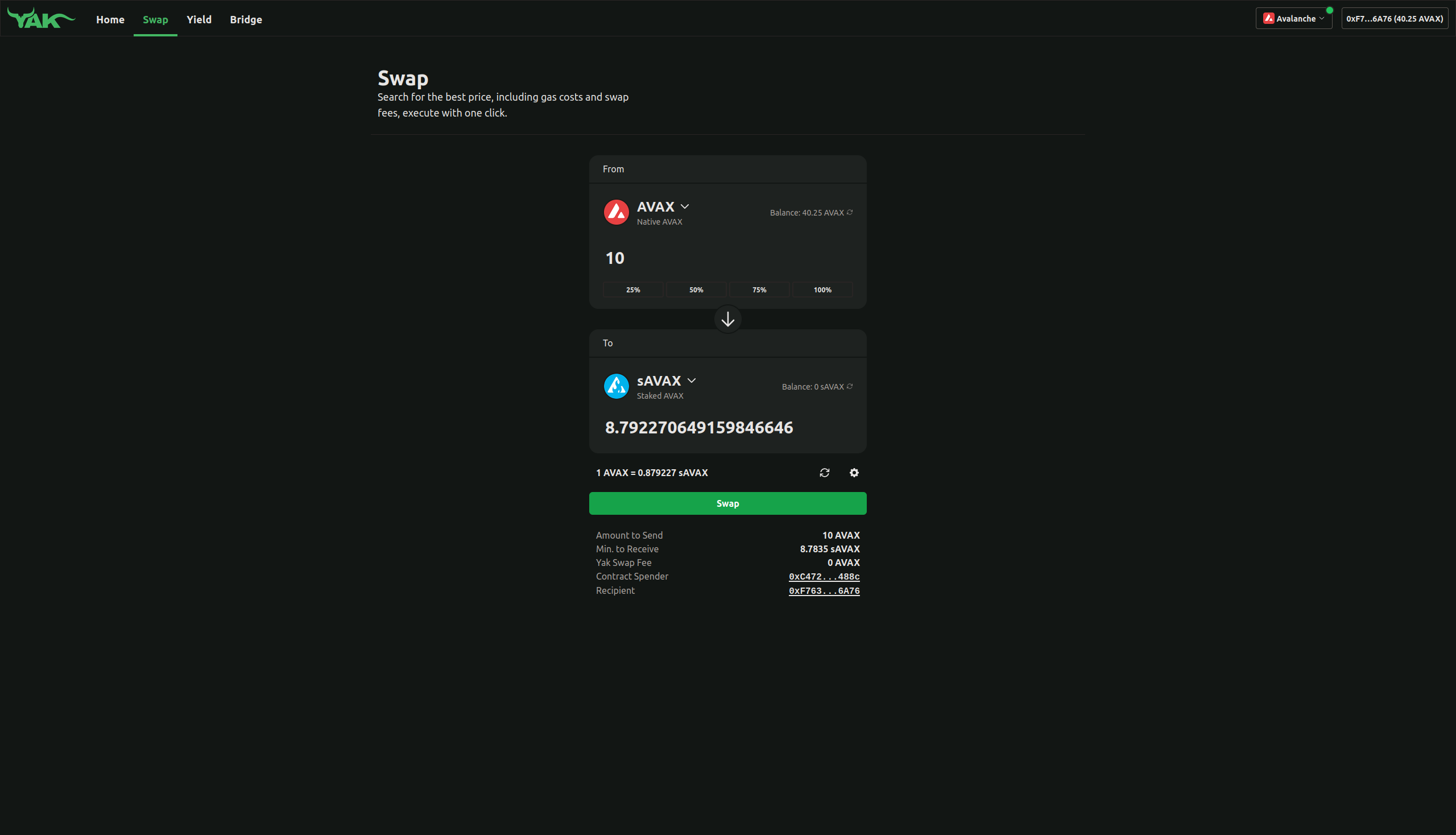

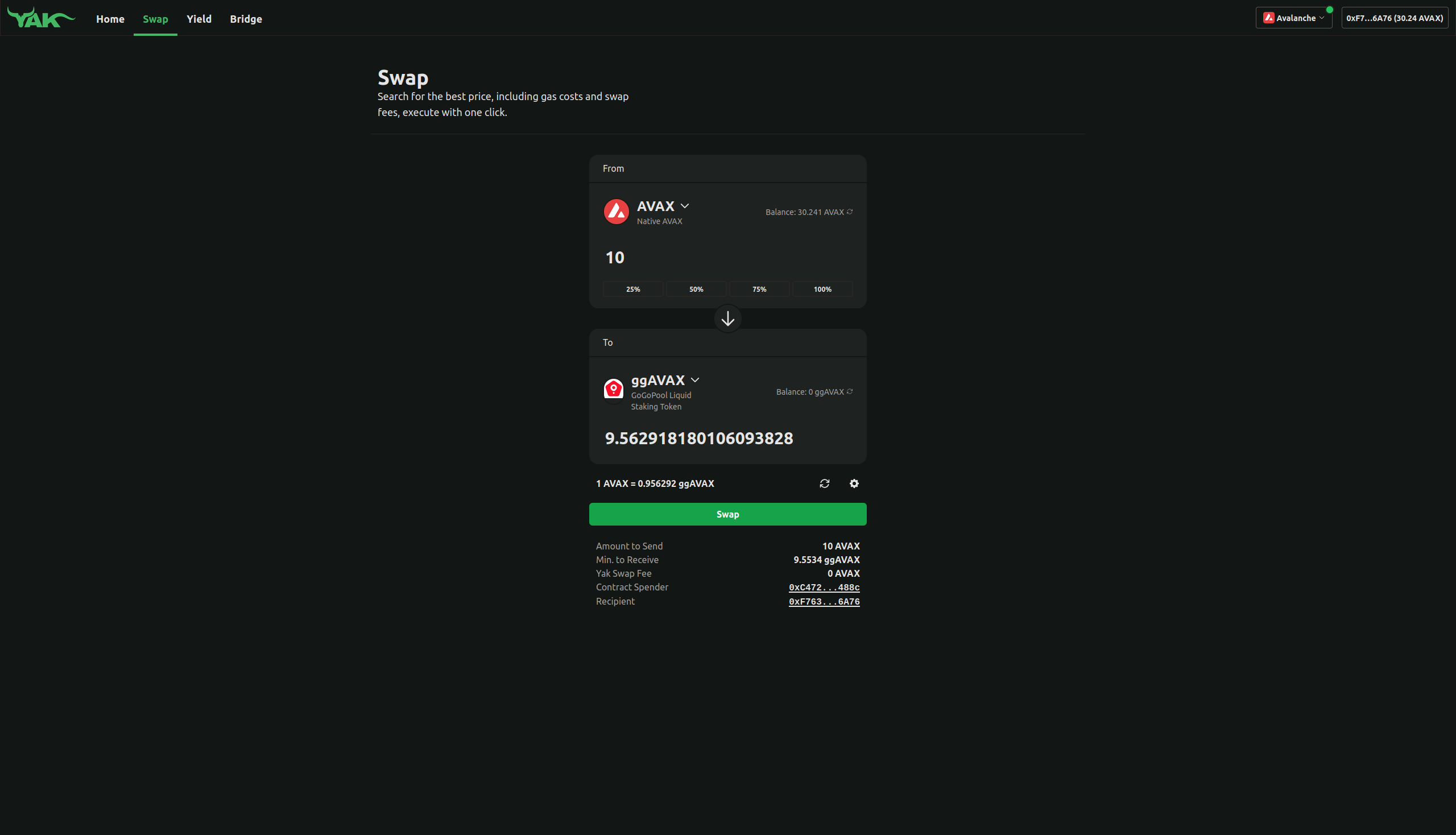

My aggregator of choice is Yak Swap, which can be accessed on Yield Yak, charges absolutely zero fees and lives entirely on-chain. For swaps involving $sAVAX, it also has the added benefit of checking the rate for and facilitating minting directly with BENQI if it provides the optimal route for your swap.

That wasn't the case in this instance, having found a better route by swapping instead. Happy with the previewed amount displayed, I pressed the Swap button and just had to confirm a single transaction to complete the exchange.

This gave me 8.7922706491 sAVAX for my 10 AVAX, which was slightly more than I would have received had I gone directly through BENQI instead.

Yak Swap doesn't currently support minting $ggAVAX with GoGoPool, so I'd still recommend checking the direct option to compare the outcome of both. When I did this, swapping offered a better rate again, so I went ahead and pressed the Swap button again to execute the trade.

This required one more transaction to complete and gave me 9.5628941891 ggAVAX in return for my 10 AVAX, which was again slightly more than going directly through GoGoPool at the time.

Whilst the differences aren't really significant for amounts of this size, it can have much more of an impact on bigger swaps, with the caveat that exceptionally large quantities will be limited by the liquidity available on the underlying exchanges. Regardless, I'd again always suggest checking an aggregator and comparing the rates to ensure that you receive the best outcome for your $AVAX to LST transactions.

Entering the Liquidity Pools on Wombat

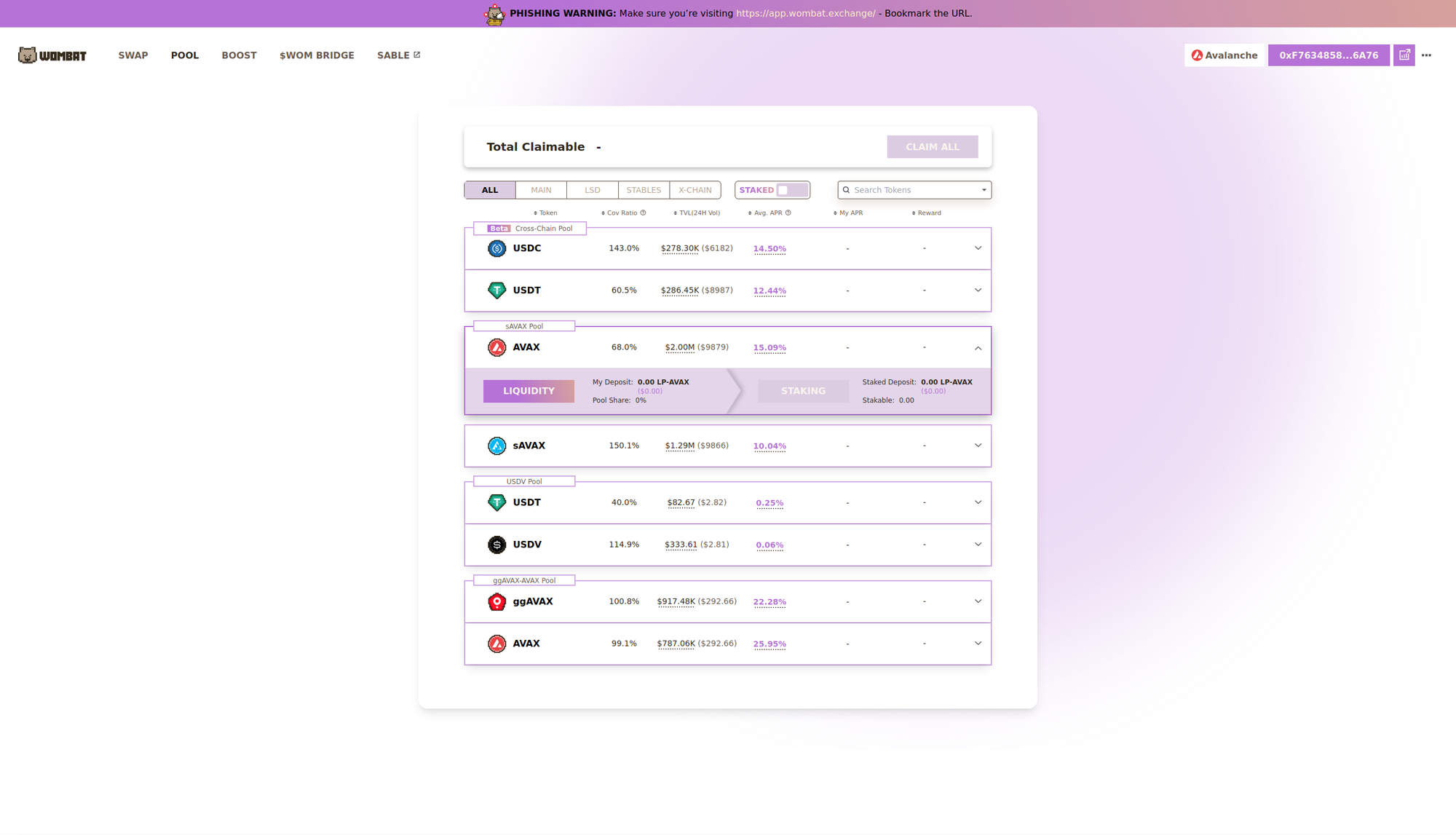

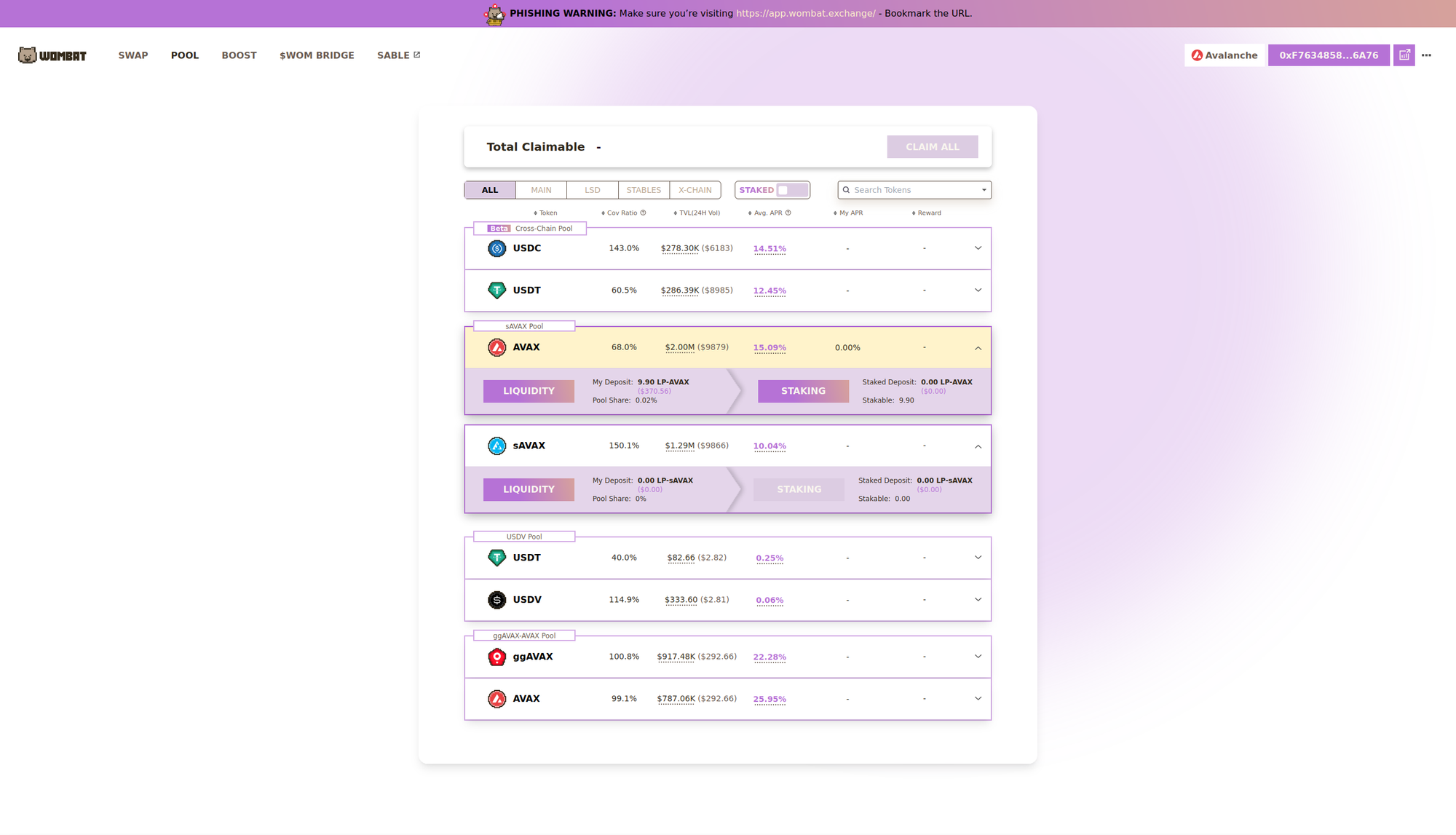

With the desired 10 AVAX and equivalent in $sAVAX and $ggAVAX to deposit in each side of the relevant pools, I visited Wombat and selected the $AVAX option of the $sAVAX pool to expand the details, before pressing the LIQUIDITY button.

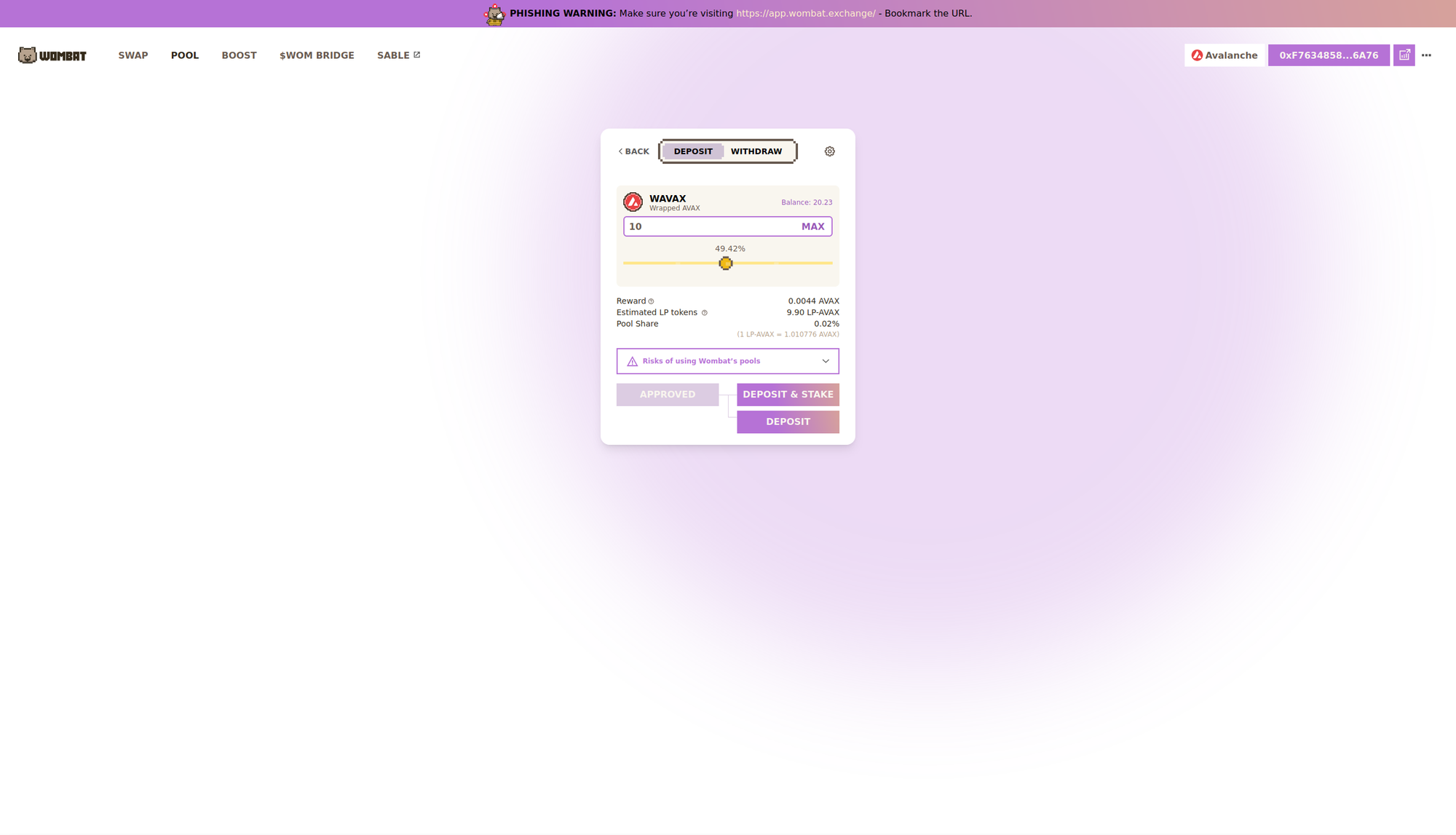

This took me to the deposit page, where I entered the 10 AVAX that I wished to add to the pool and then pressed the DEPOSIT button. It's important to use this rather than the DEPOSIT & STAKE option, as the boosted Yield Yak pools require you to deposit the LP tokens you receive for providing liquidity, and can't be used if they're already staked.

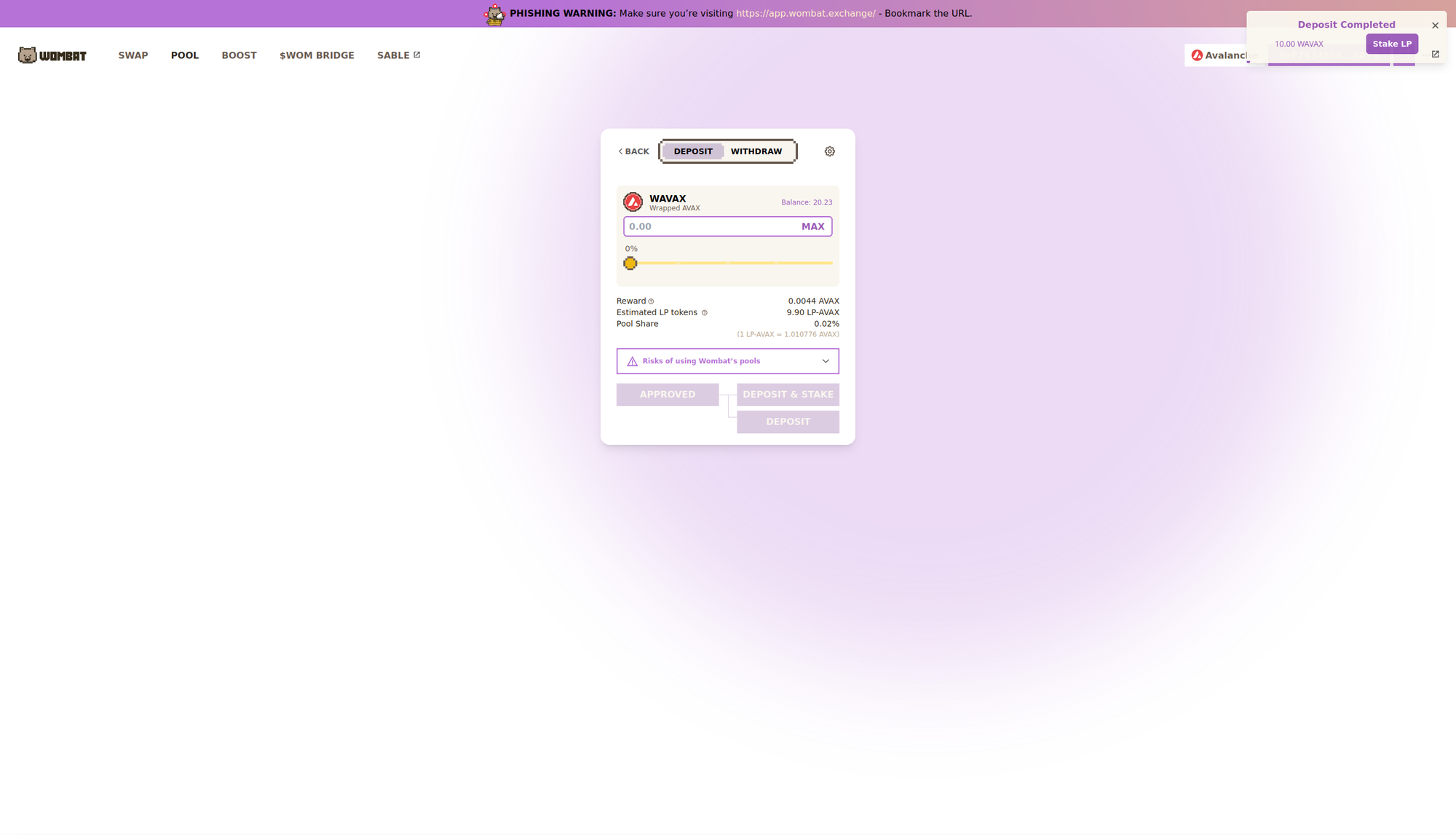

There was just one transaction required for this deposit, and the page automatically updated to notify me in the top-right corner once it had been confirmed. For the 10 AVAX deposited, I received 9.8977362206 LP-WAVAX tokens in return, which represent my position in the pool.

With my first deposit complete, I then pressed the BACK button towards the top of the page to return to the list and selected the $sAVAX option of the same pool. My new unstaked position in the $AVAX side of it was also immediately visible.

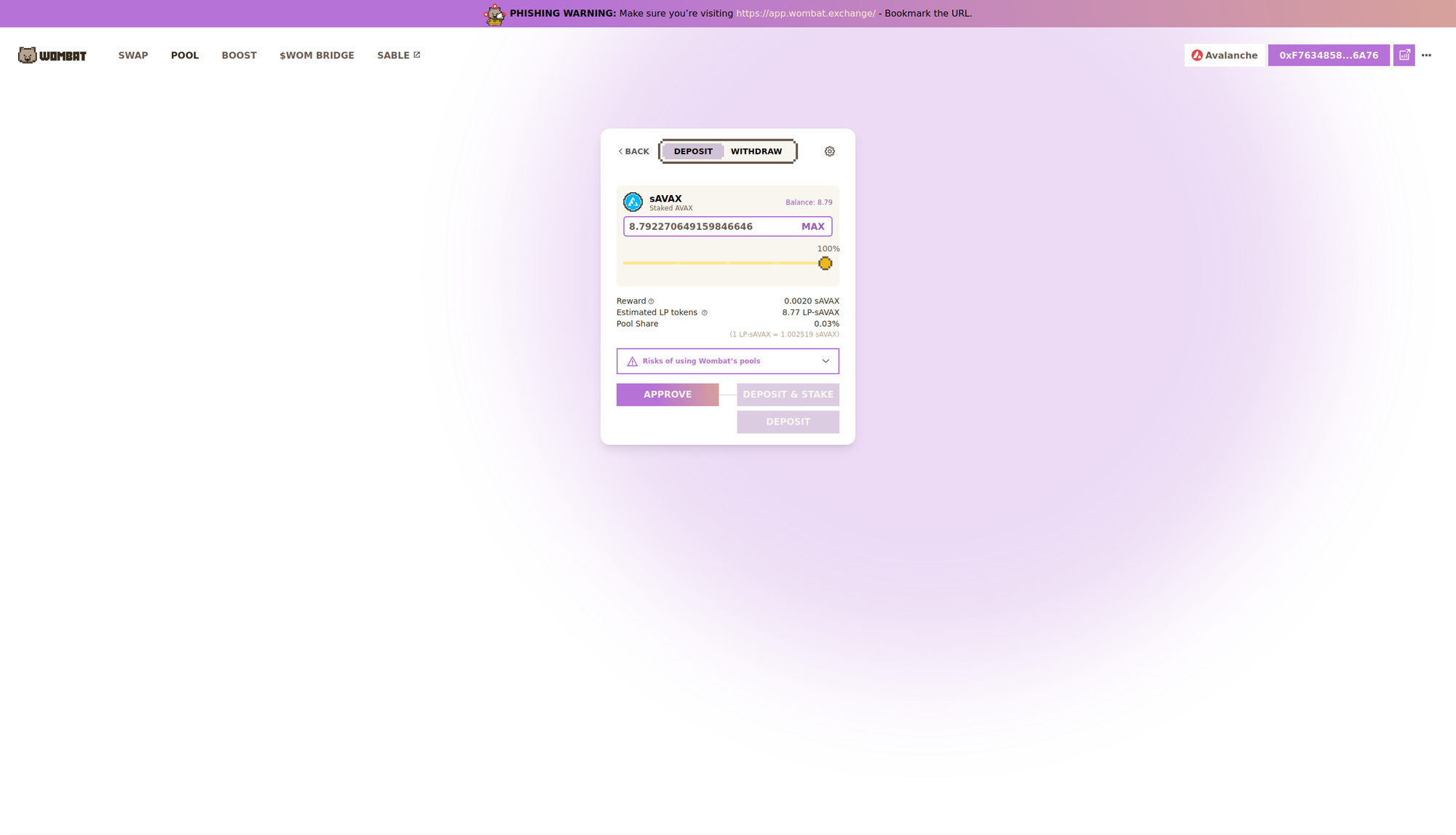

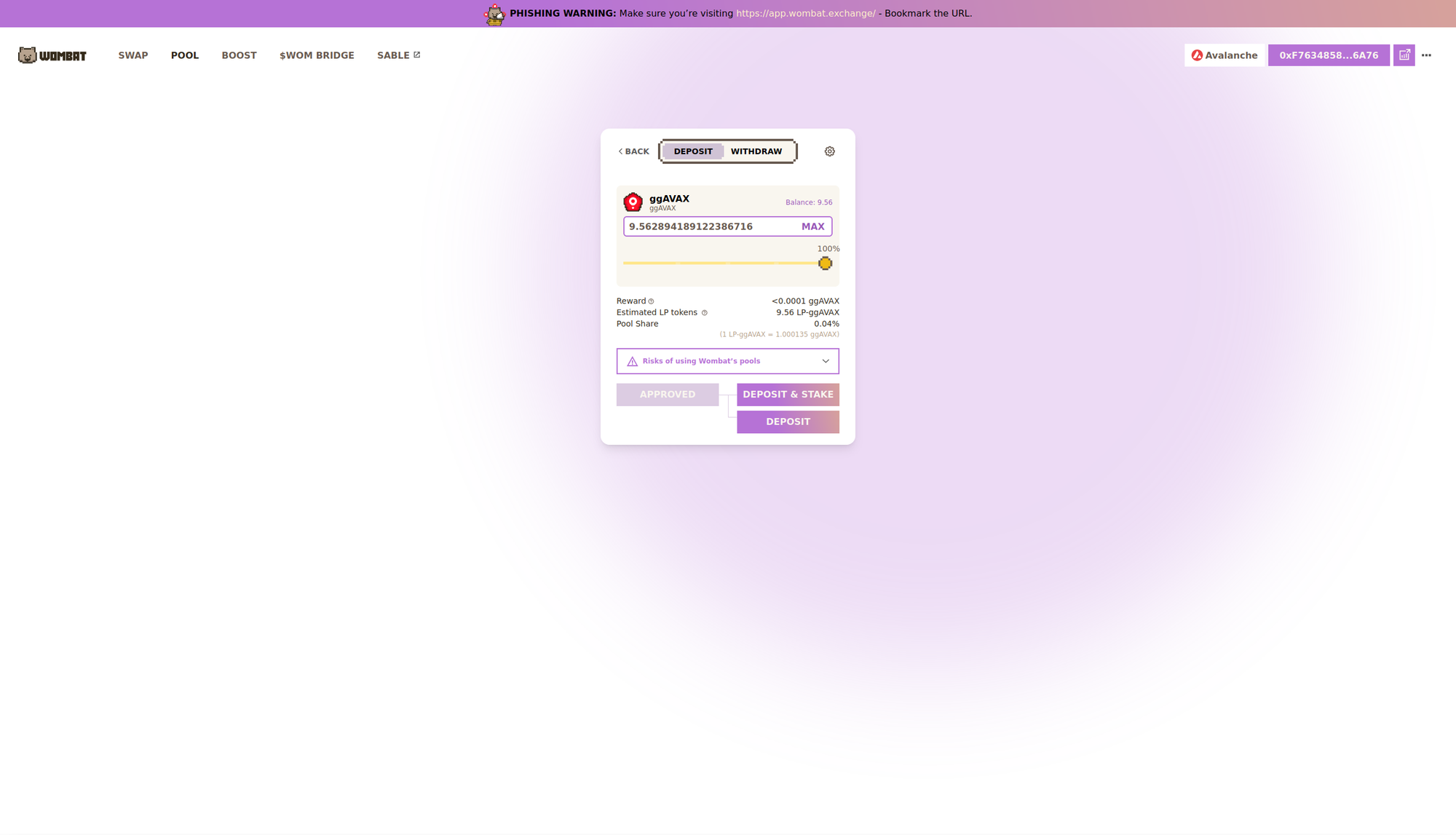

After pressing the LIQUIDITY button to continue to the deposit page, I selected the MAX option to ensure my full balance was selected to be added to the pool. Since I was depositing $sAVAX rather than native $AVAX this time, there was an additional approval required by pressing the APPROVE button before being able to proceed.

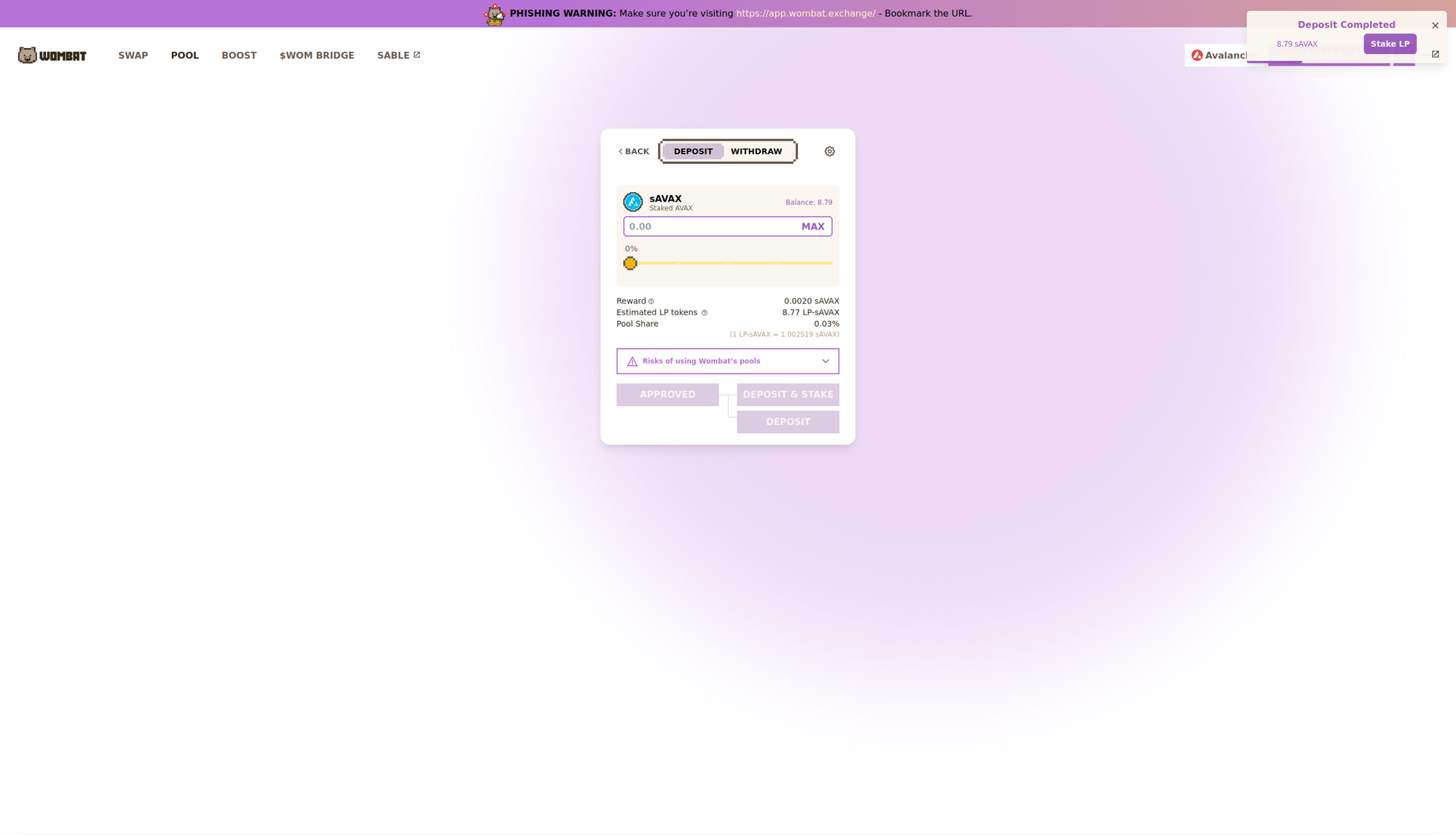

There was one transaction required for the approval and I then followed the same steps as before, making sure to press the DEPOSIT button rather than choosing to stake the LP tokens as well.

The deposit itself needed one more transaction and gave me 8.7721307464 LP-sAVAX tokens in return for the 8.7922706491 sAVAX added to the pool.

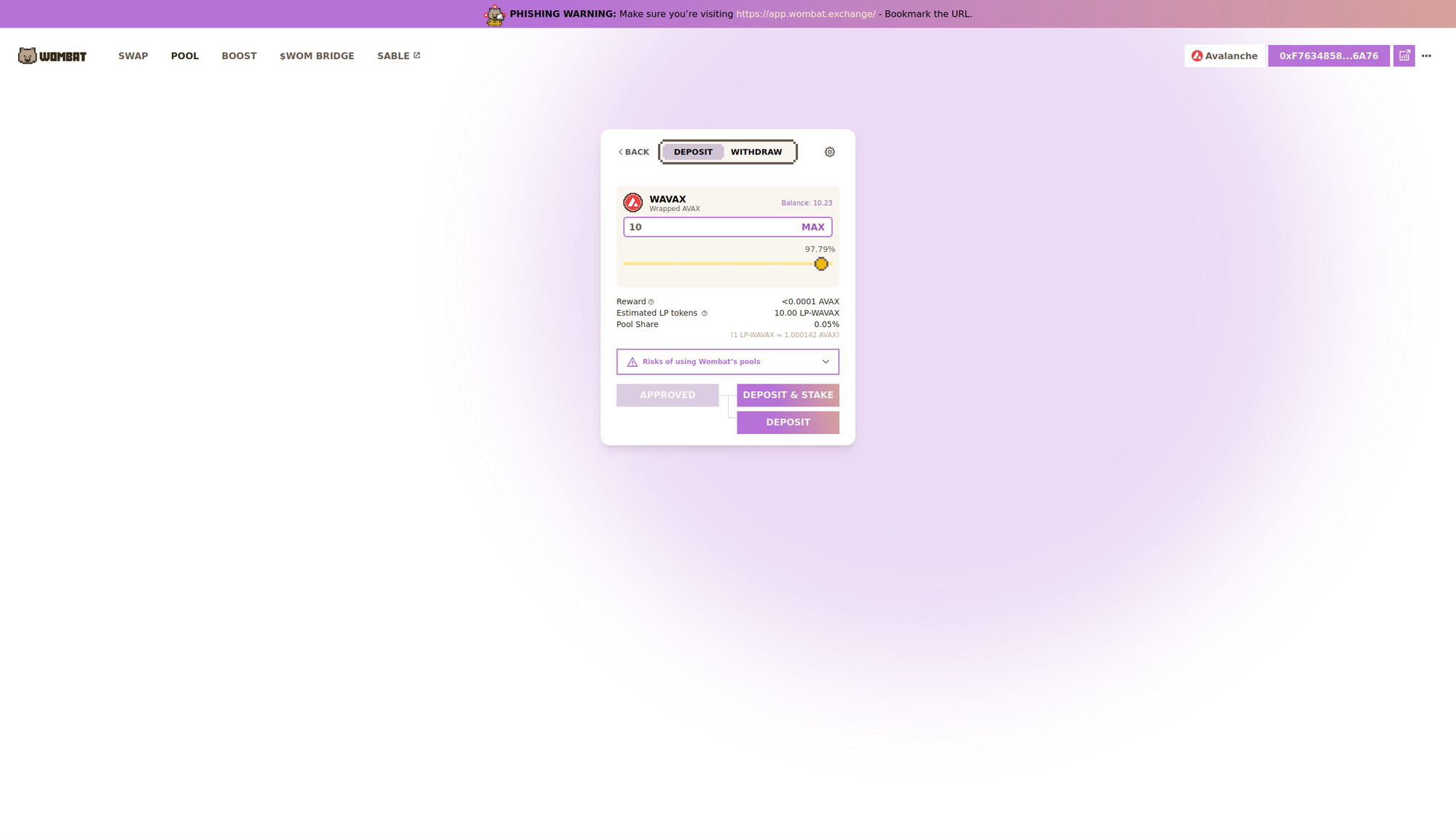

Providing liquidity to the $ggAVAX pool followed the exact same process as for the $sAVAX pool, returning to the list, selecting the $AVAX option, pressing the LIQUIDITY button and then ensuring to press just the DEPOSIT button.

Again, just a single transaction was needed for this one and I received a total of 9.9985841583659 LP-WAVAX for the 10 AVAX deposited.

Repeating the now very familiar steps for the $ggAVAX option of the same pool required one more transaction for the approval and a final transaction to complete the process on Wombat.

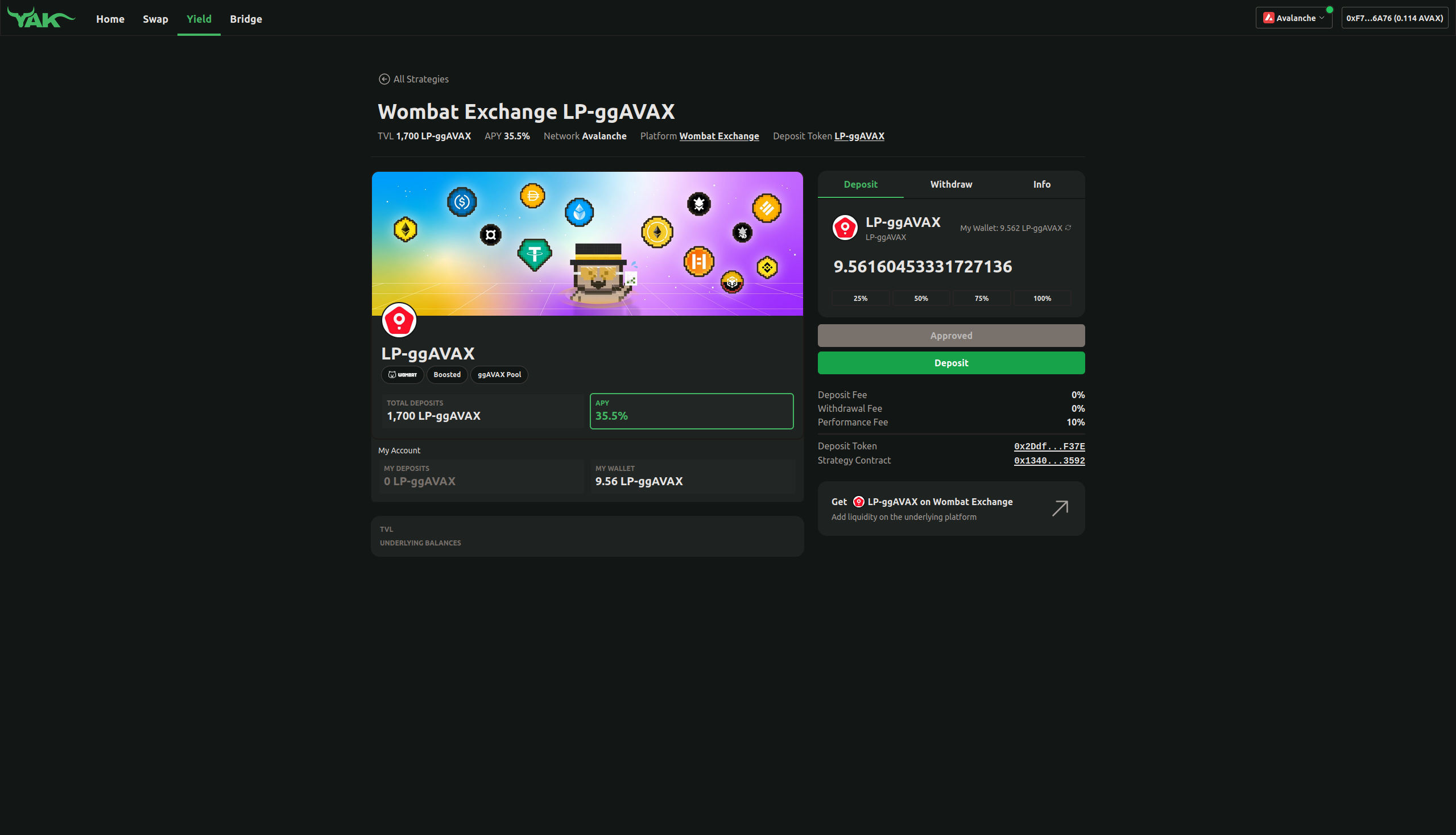

For this one, I again pressed the MAX button to deposit my full 9.5628941891 ggAVAX balance, and got 9.5616045333 LP-ggAVAX for doing so.

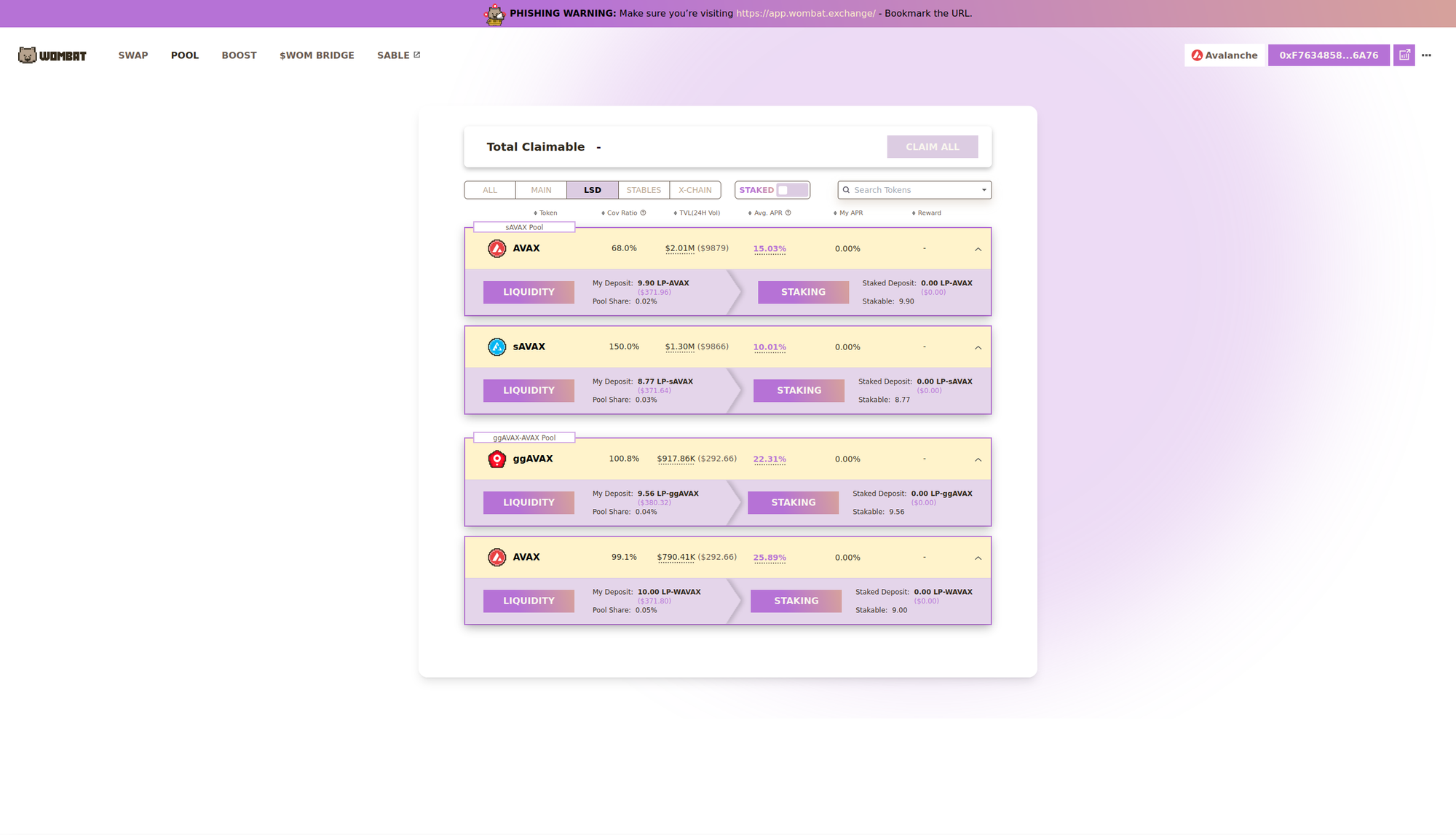

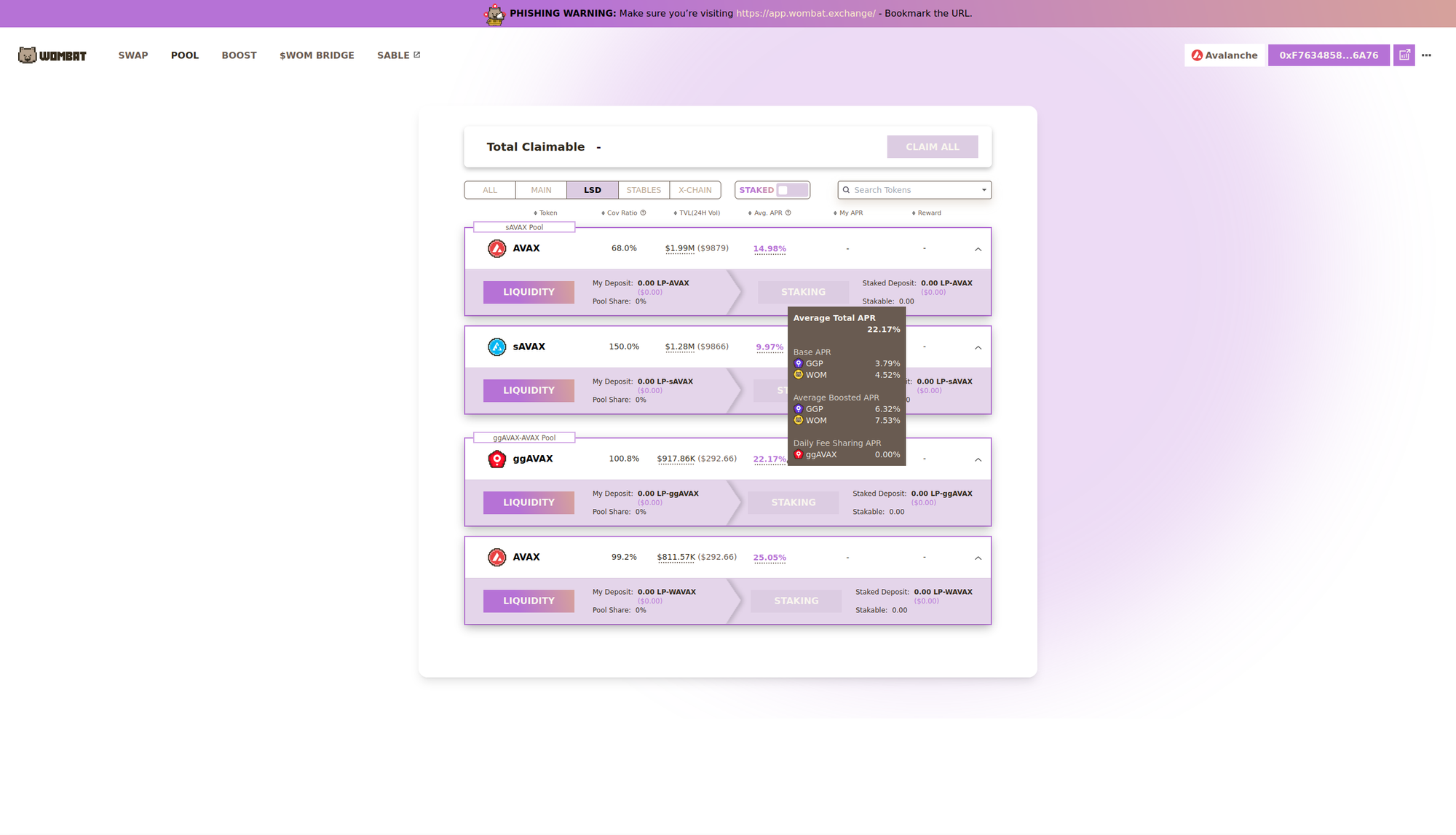

To confirm that my deposits were successful and displaying as expected, I returned to the list of pools and selected the LSD tab along the top to filter just those related to liquid staking tokens, as they are the only pools that I had provided liquidity to.

The entire process up to this point was really quite gas efficient, including the initial swaps for $sAVAX and $ggAVAX on Yak Swap, costing just 0.032826575 AVAX in fees. This left me with 0.217173425 AVAX for the remaining steps.

Entering the Boosted Pools on Yield Yak

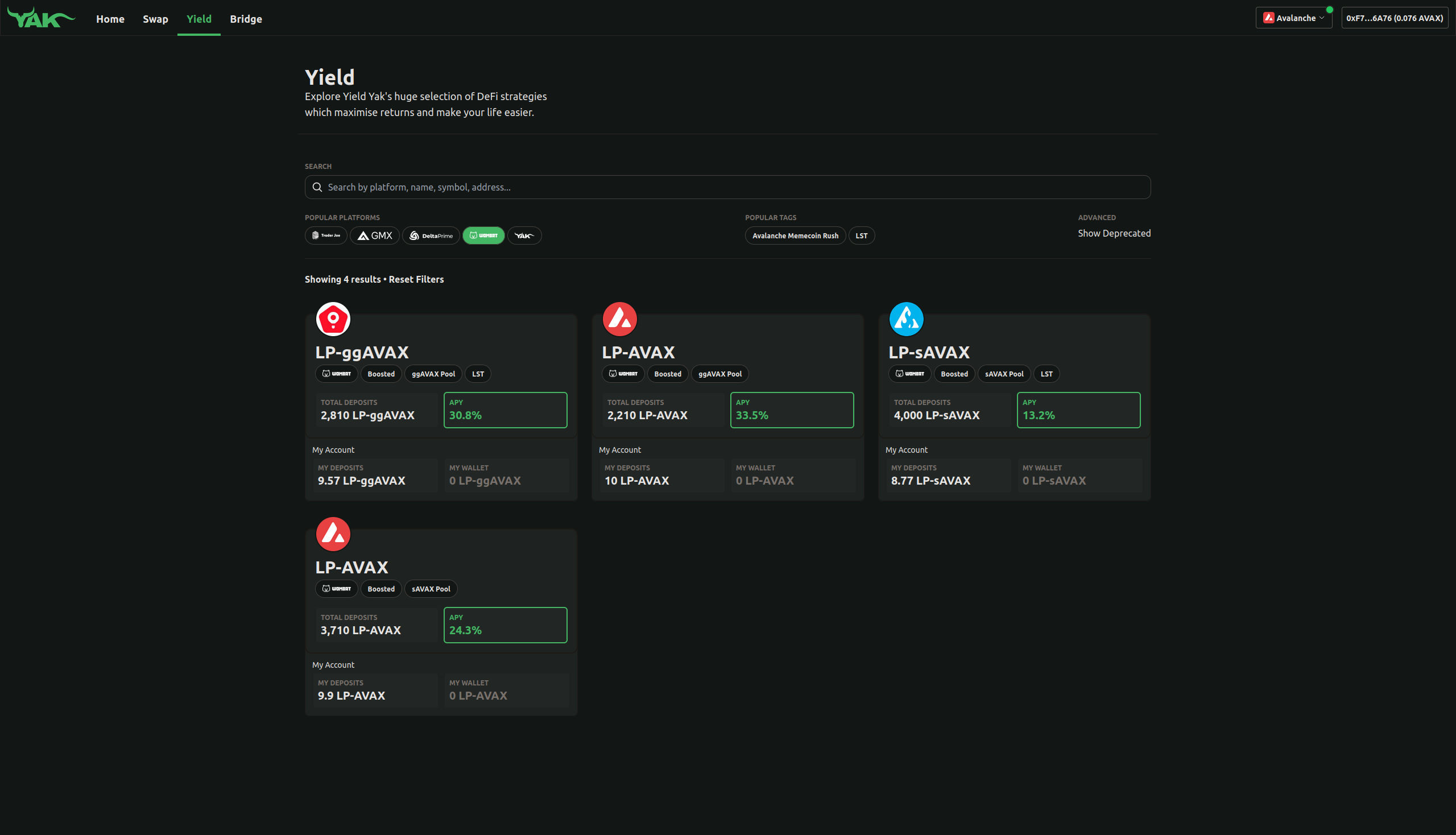

After providing liquidity to both sides of the $sAVAX and $ggAVAX pools on Wombat, the next step was to head to Yield Yak and deposit the LP tokens representing my positions in the boosted pool for each of them.

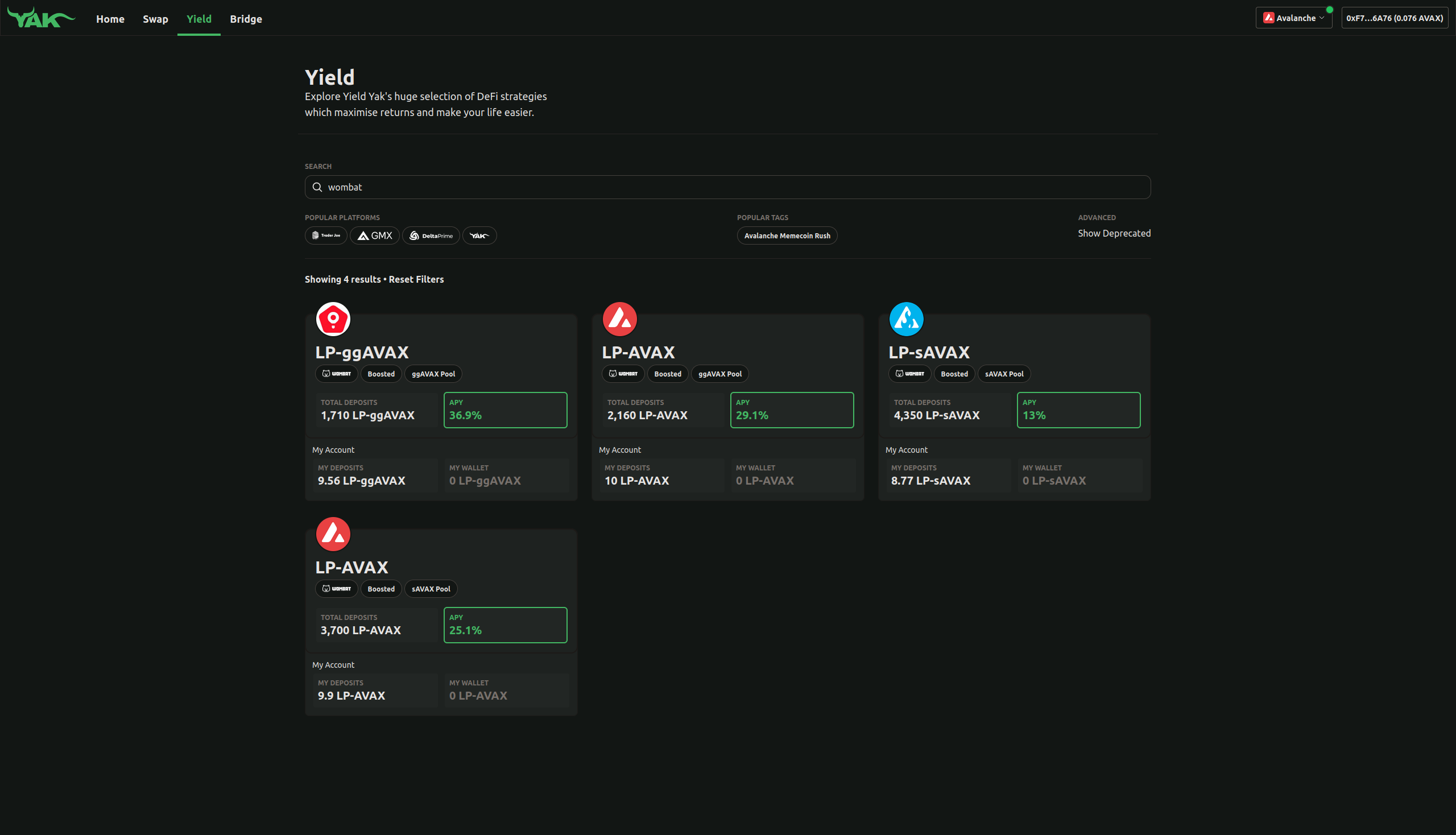

To quickly find the relevant pools, I selected the Yield option from the menu at the top of the page and then pressed the Wombat filter just underneath the search bar. This filtered it down to just the four I was interested in, and showed my LP token balance next to each.

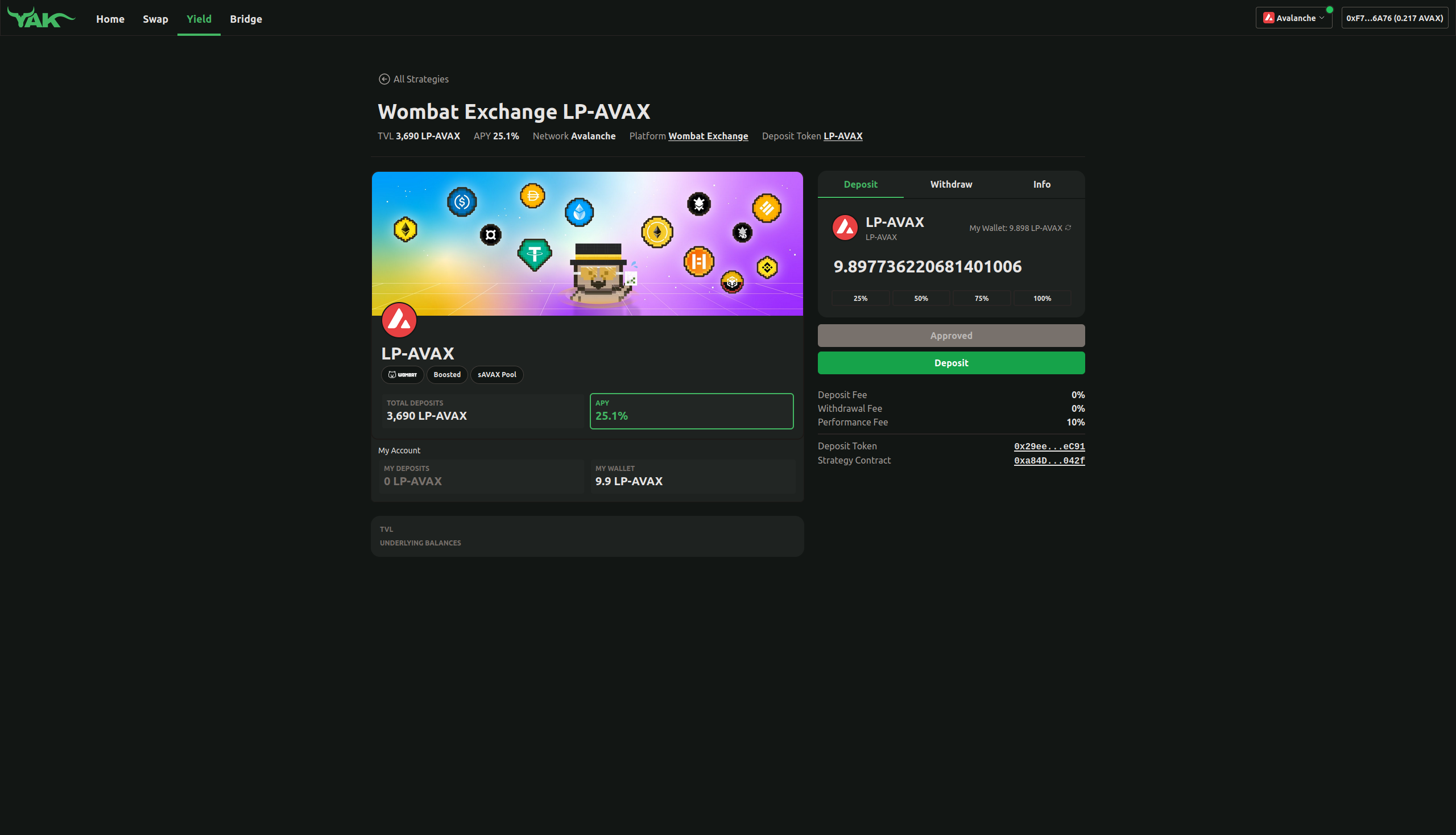

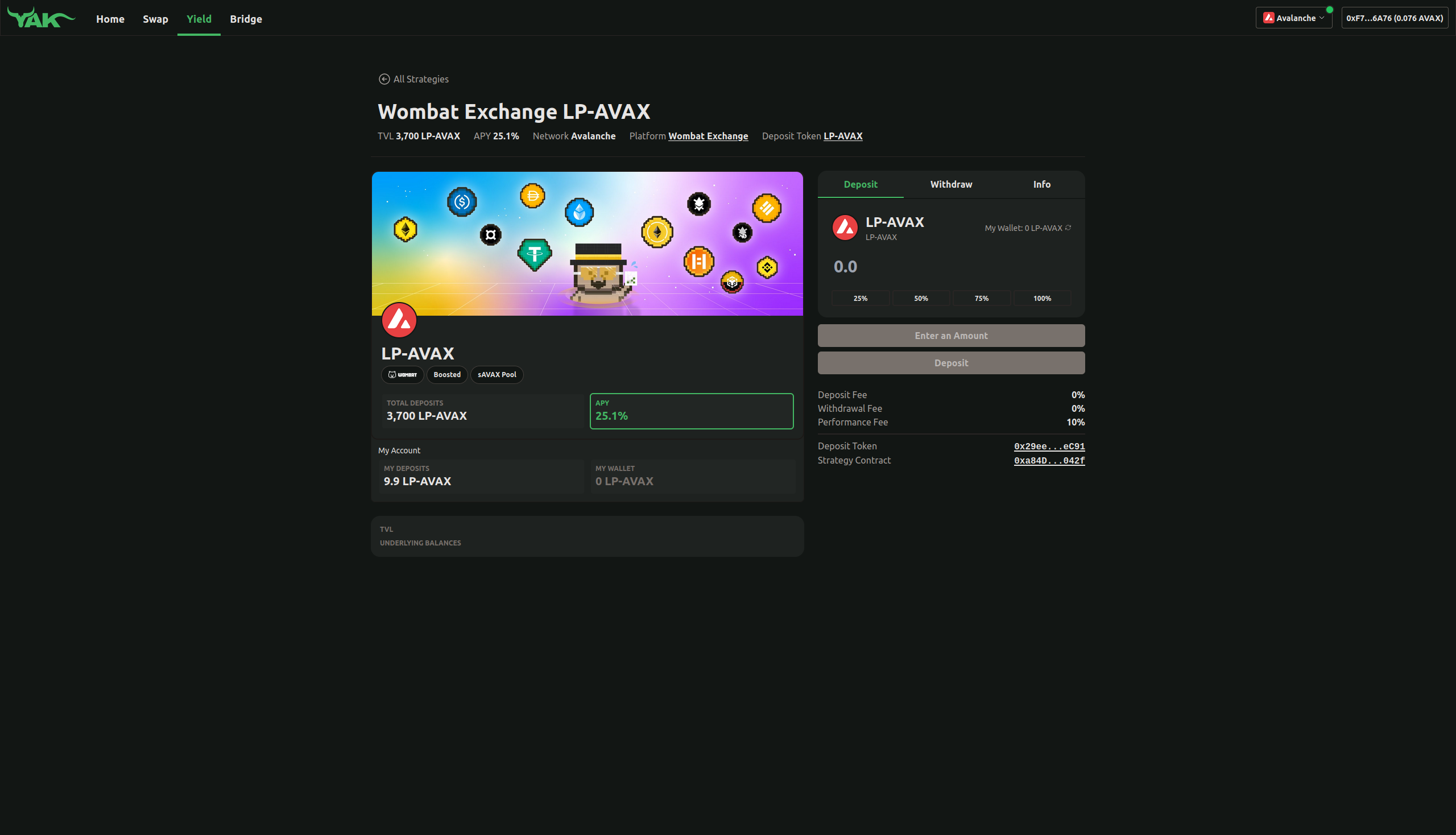

Following the same order as on Wombat, I started with the $AVAX side of the $sAVAX pool. This was the second LP-AVAX option on the list, differentiated by the sAVAX Pool tag found just underneath the name.

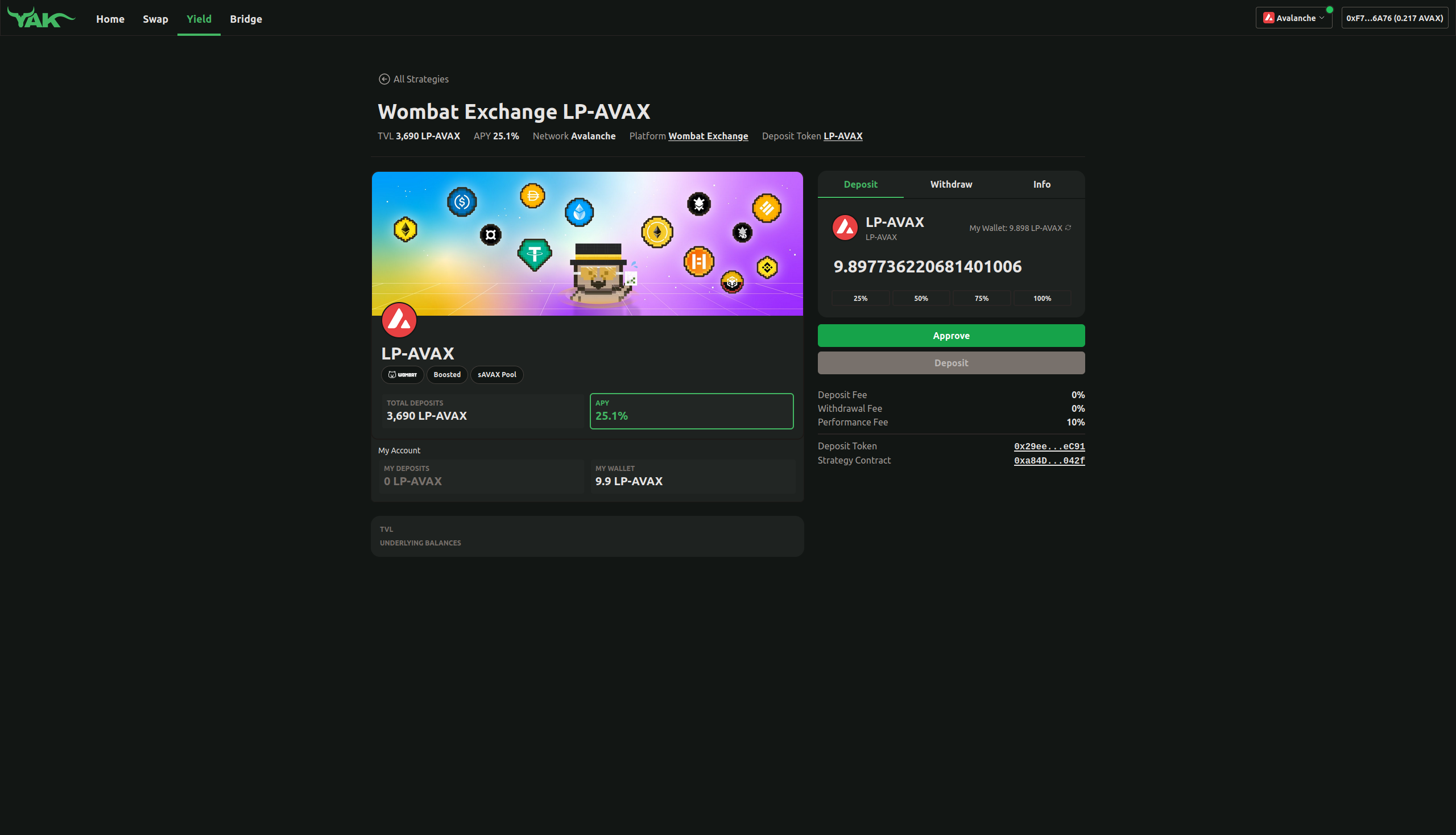

Once on the correct pool, I selected 100% to make sure that I deposited the full balance of my LP-WAVAX tokens and then pressed the Approve button.

The approval required one transaction and allowed me to press the Deposit button once it was confirmed, to continue with the process.

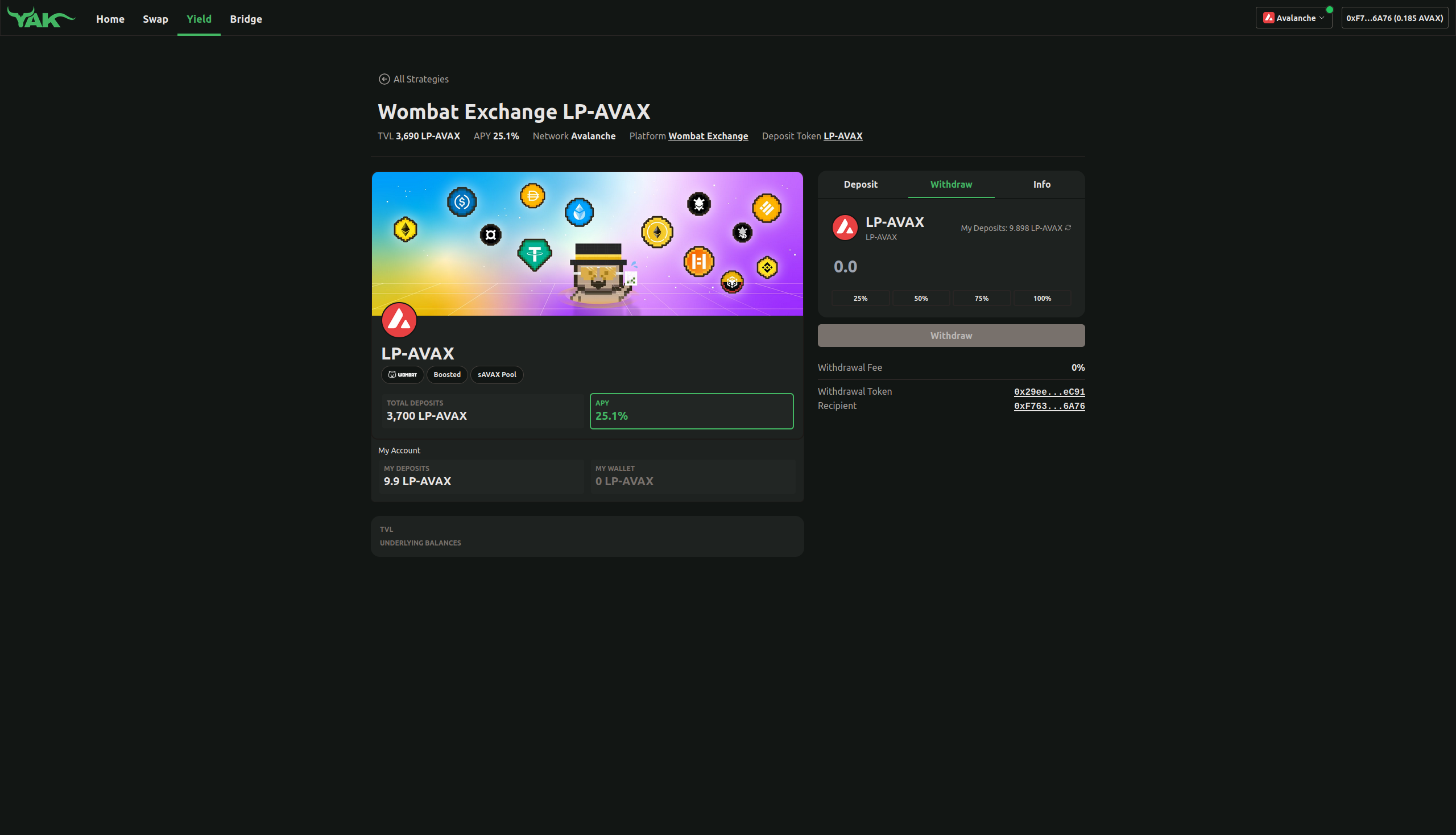

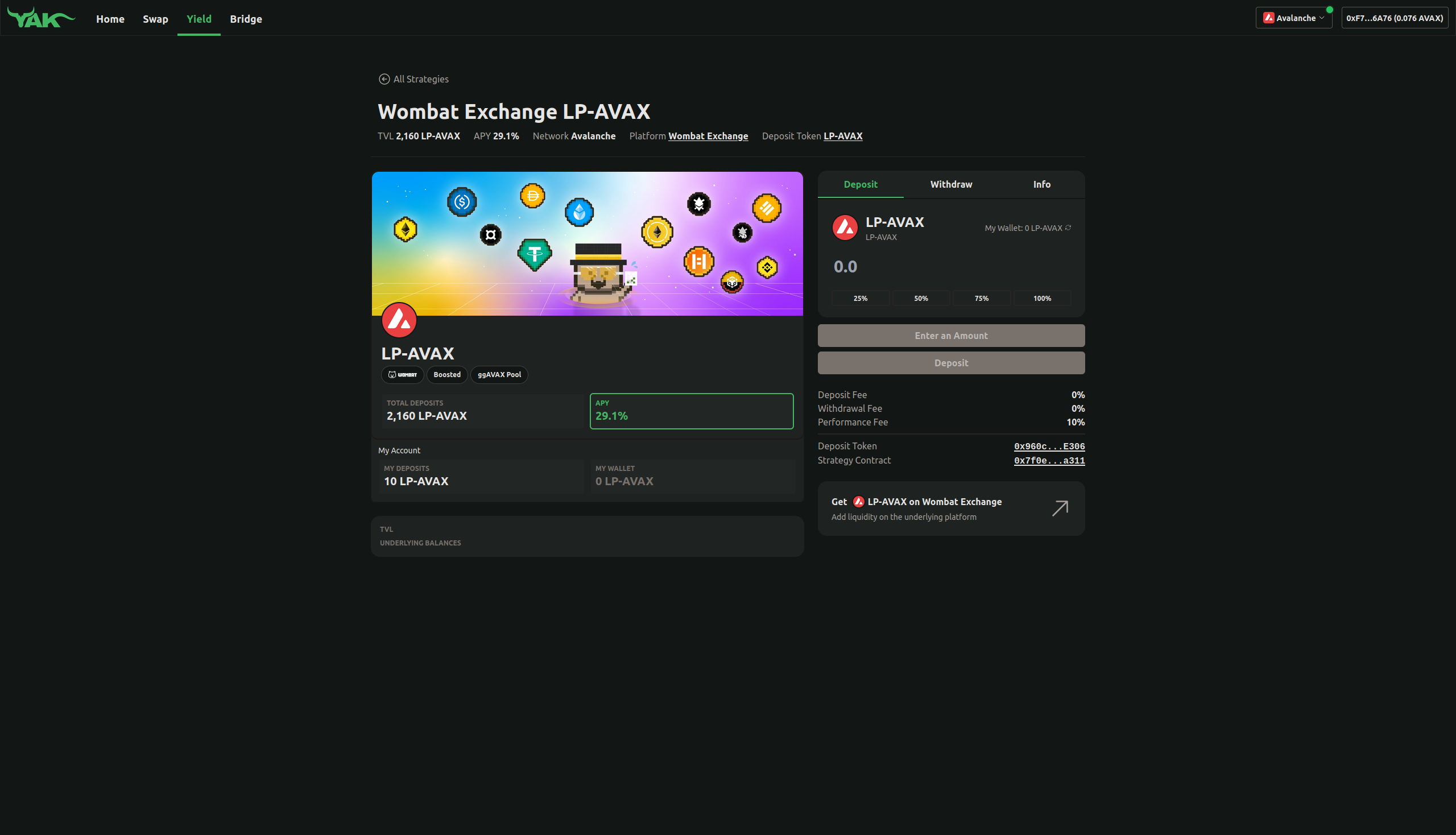

There was another transaction required for the deposit and a notification was displayed when it was complete, although I missed it in my screenshot. The balances automatically updated as well, showing my LP tokens in the MY DEPOSITS section rather than in the MY WALLET section they were in before. This can be confirmed by switching to the Withdraw tab to view the full balance as well.

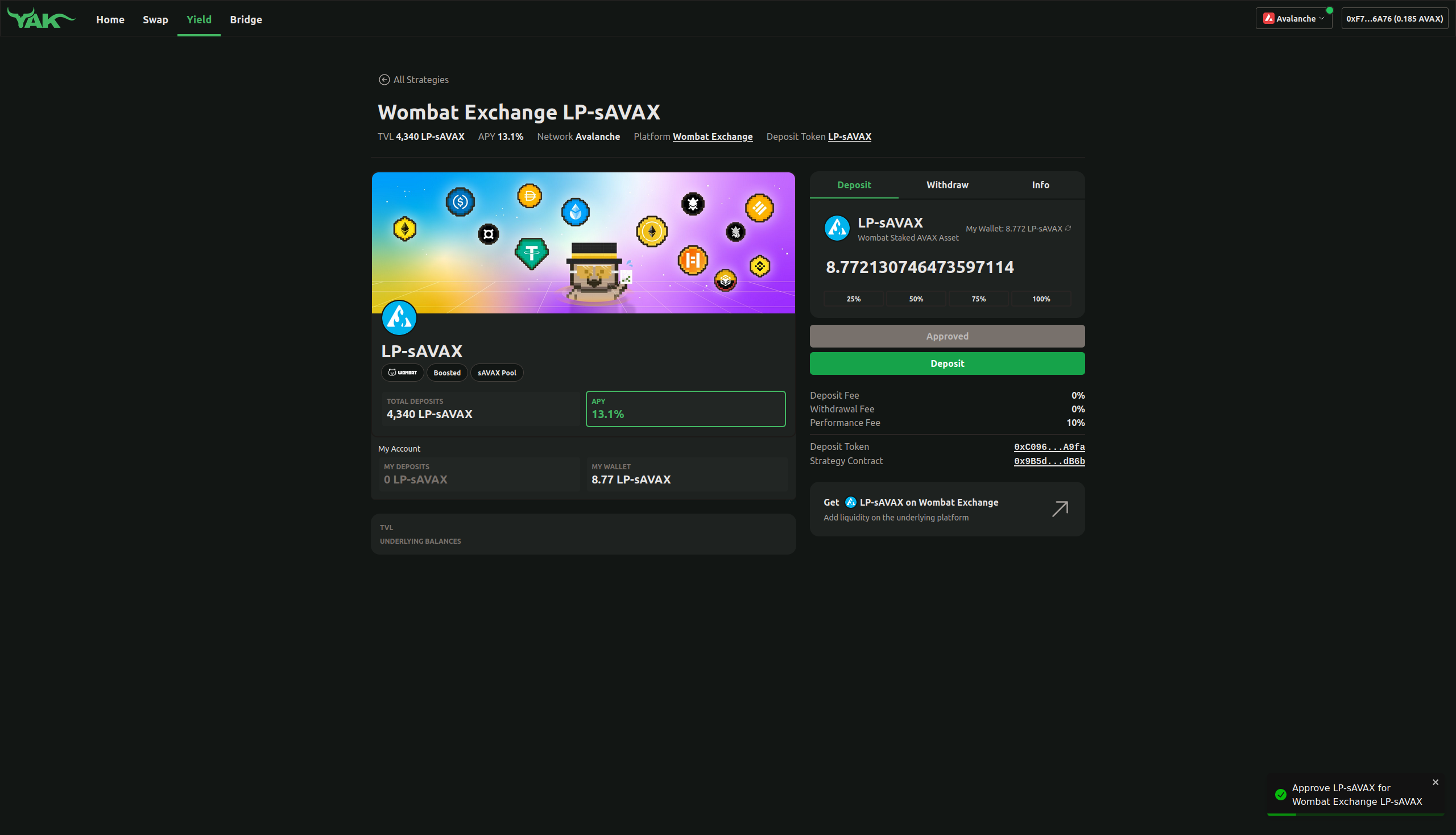

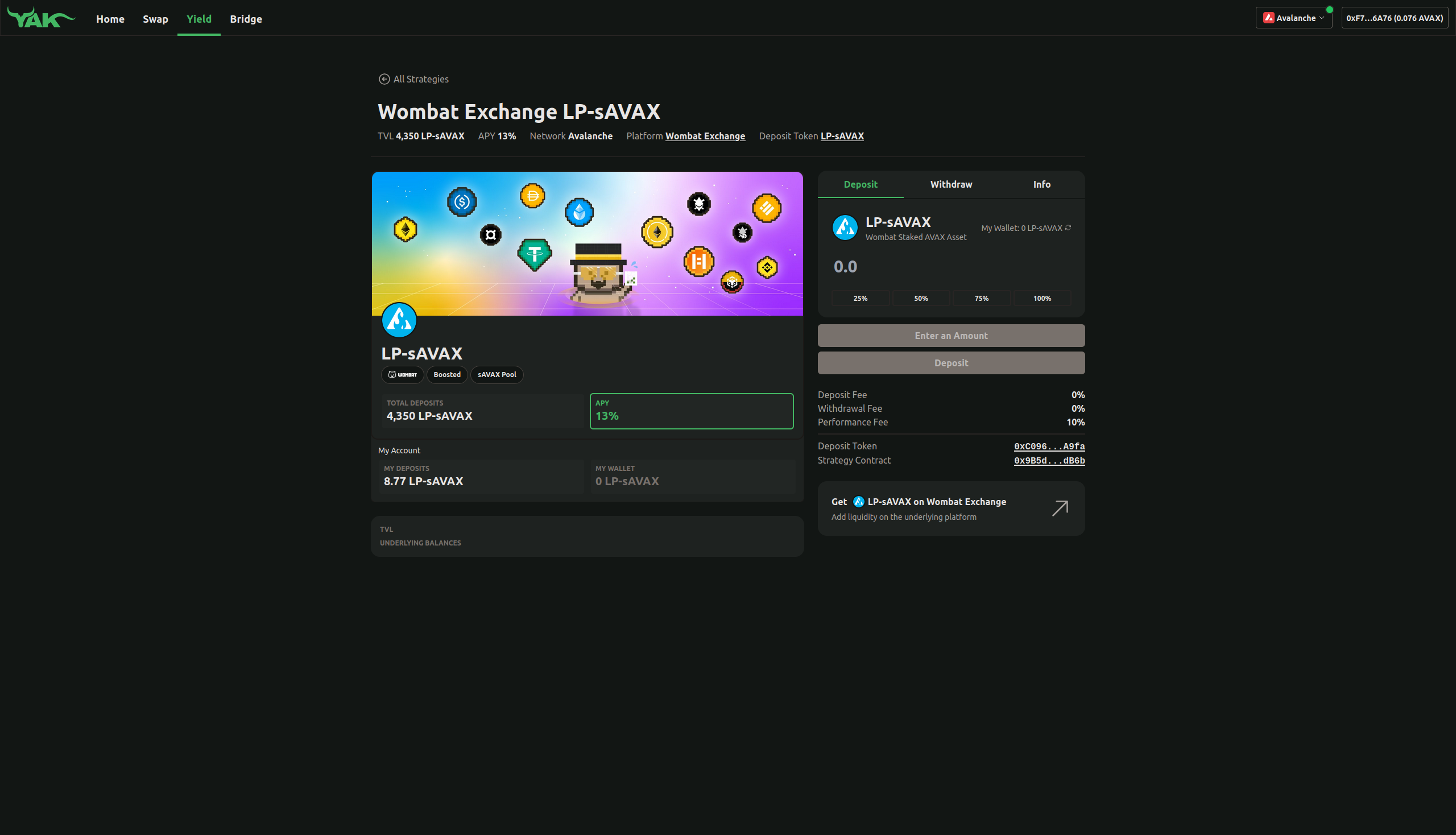

Next was the $sAVAX position, which corresponds with the LP-sAVAX option. Again, this needed one approval transaction and one deposit transaction, and both notified me and updated to reflect my balances once complete.

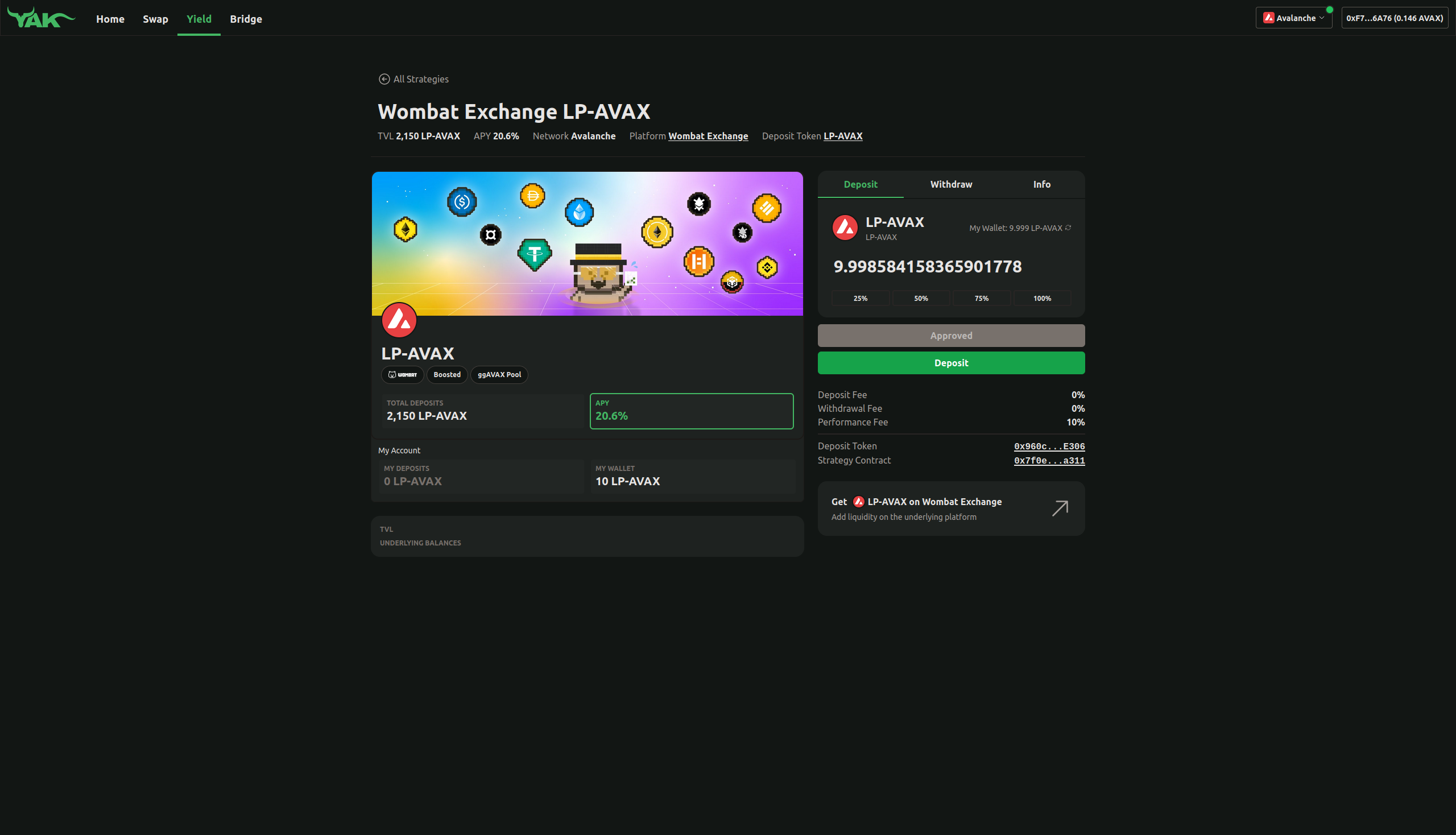

My $AVAX deposit in the $ggAVAX pool followed, found by selecting the option also called LP-AVAX but labelled with the ggAVAX Pool tag this time.

There was another approval transaction and then another deposit transaction required for this, with me once again being notified and my balances updated accordingly.

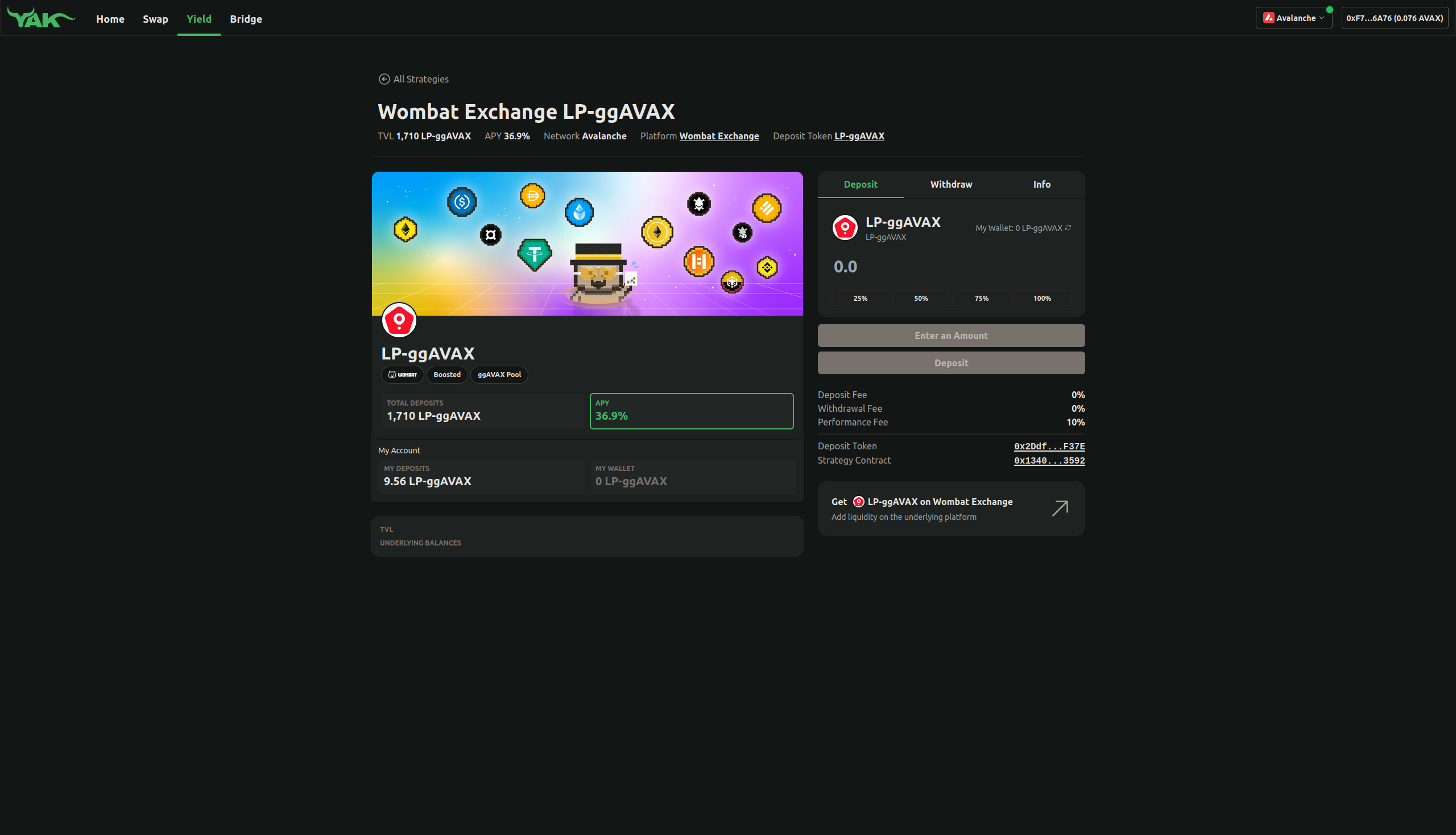

The final deposit was of my $ggAVAX position to the LP-ggAVAX pool. Once again, I had to confirm one approval transaction before the last deposit transaction in order to complete the entire process, seeing one more notification and balance update upon confirmation.

With all said and done, this left me with 0.0761952 AVAX of the 0.25 AVAX that was originally allocated for gas, meaning a grand total of 0.1738048 AVAX was spent on these fees.

This was more than I was expecting, to be completely honest, particularly as the previous steps were so cheap in comparison. However it made sense after taking a look at the deposit transactions, as each one also reinvests the rewards accrued within that pool. This mechanic ensure that new depositors don't take advantage of the yields accumulated from existing depositors.

Projections

For each of the following projections, I'll be assuming that both the rates for the providing liquidity to these pools on Wombat and the yield for the underlying liquid staking tokens remains the same for the duration.

To keep things consistent, I'll also be calculating the figures in $AVAX terms for all pools, meaning that I'll be using an initial deposit value of 10 AVAX for each rather than the quantity of $sAVAX or $ggAVAX instead. This is the amount used to exchange for these tokens, so represents the underlying value of my deposits.

With that in mind, the $AVAX side of the $sAVAX pool currently has an APY of 25.1%, so I can expect to earn the following on my 10 AVAX deposit:

- 1 week - 0.0482692307 AVAX

- 1 month - 0.2091666666 AVAX

- 1 year - 2.51 AVAX

The $sAVAX side of the same pool has an APY of 13% at the moment, but this doesn't include the underlying ~5.75% APR liquid staking yield. Combining both gives an overall APY of around 18.75% which means that I should earn the following on the 10 AVAX backing my 8.7922706491 sAVAX deposit:

- 1 week - 0.0360576923 AVAX

- 1 month - 0.15625 AVAX

- 1 year - 1.875 AVAX

There is currently an APY of 29.1% for the $AVAX side of the $ggAVAX pool, which should allow me to earn the following on the 10 AVAX deposited into it:

- 1 week - 0.0559615384 AVAX

- 1 month - 0.2425 AVAX

- 1 year - 2.91 AVAX

Lastly, the $ggAVAX side of that pool has an APY of 36.9% at the moment, again excluding the ~7.24% APY from the underlying liquid staking yield. The total APY when combining both comes to 44.14% and means that I'll be expecting to earn the following on the original 10 AVAX used to obtain the 9.5628941891 ggAVAX added to the pool:

- 1 week - 0.0848846153 AVAX

- 1 month - 0.3678333333 AVAX

- 1 year - 4.414 AVAX

Other Considerations

There are a number of factors that will affect the above, however, all of which may result in the effective rates coming out higher or lower than the figures above when reviewed:

- All pools currently receive $WOM rewards, with the $sAVAX and $ggAVAX pools also receiving $QI and $GGP respectively. If the price of these rise relative to the price of the pooled assets then it will increase their effective rate, with the inverse applying if their price decreases instead.

- The quantity of pooled assets has a similar effect, but with an increase relative to the rewards reducing the APY, as the same amount must then be split between more deposits. The rate will rise instead if there is a net decrease of pooled assets, as there are then fewer deposits to share with.

- Liquidity providers also receive a share of the swap fees. As volume through their pools increases, so will the revenue from these fees and therefore the overall rate for those pools. Likewise, decreased volume leads to a lower rate due to less fees being collected.

- The boost provided by the Yield Yak is affected by the quantity of assets deposited to the pools as well, with the impact being larger when there are fewer deposits and gradually reducing as they increase.

- Deposit gains and withdrawal fees are implemented based on the coverage ratio of the assets within a pool. Whilst usually minimal and offset quickly by the yield, these can cause an immediate loss or gain if a pool is severely imbalanced and heavily skewed towards one of the assets it's comprised of.

I'll expand on a couple of these points in the conclusion below, as there are some ways to benefit and future developments may change the impact some have as well.

Conclusion

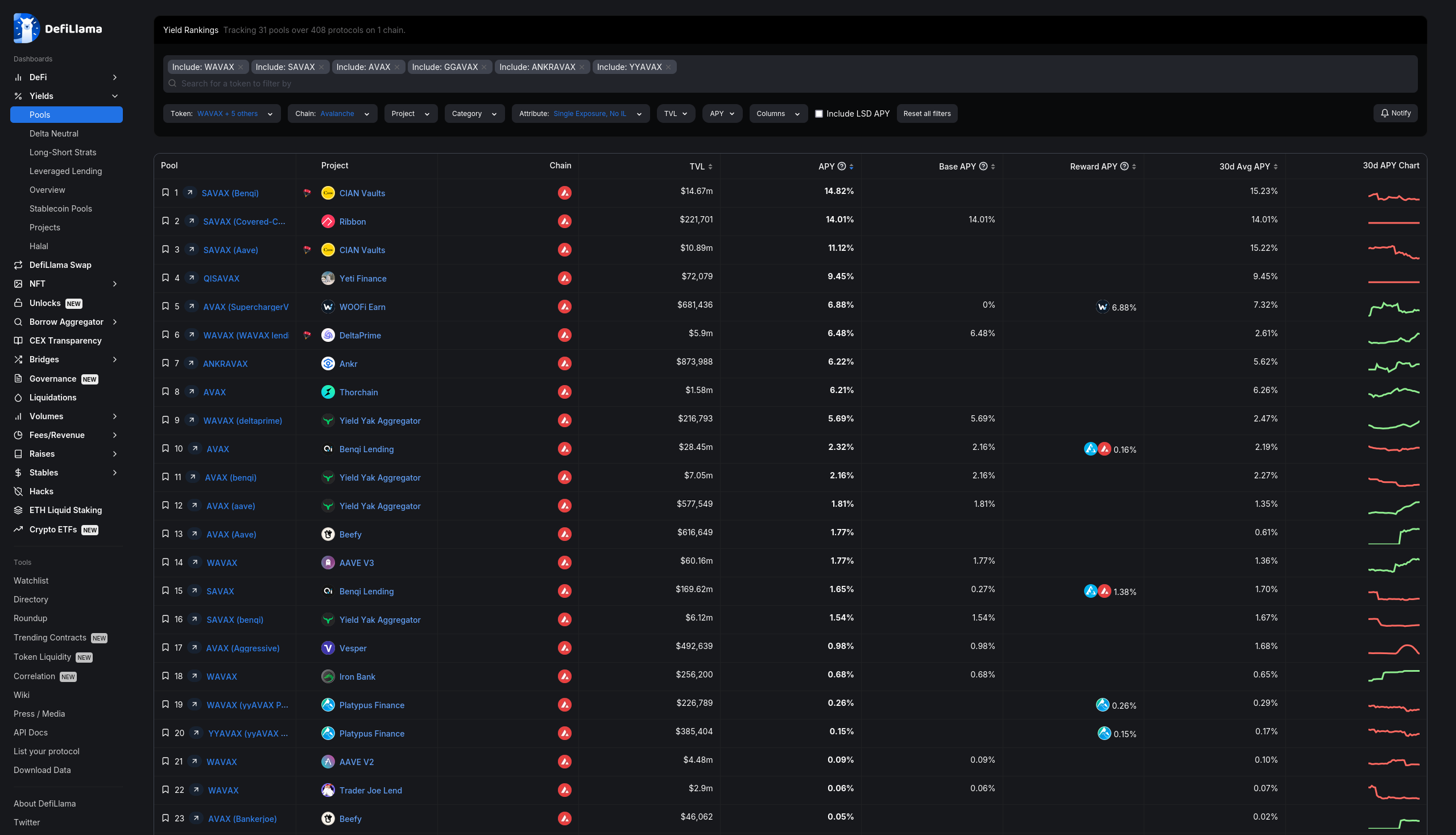

In terms of yield, all of these Wombat pools boosted by Yield Yak would actually take the top four spots on DefiLlama when looking at comparable options. The rates are, quite frankly, outstanding at the moment. They even beat some leveraged strategies, such as those offered by CIAN and Definitive, which I think is really impressive.

The rates come close to some of the maximum possible when leveraging the Balancer LST pools through DeltaPrime as well, which again is quite a feat! It also highlights the potential for these pools if we were to see them integrated on DeltaPrime in the future as well, as if they're already close to parity on yield without the impact of leverage.

This has benefits for the wider Avalanche ecosystem as well, as those seeking such yields would significantly deepen the liquidity in the pools, allowing for reduced slippage and better pricing on larger swaps, driving more volume through the pools and in turn increasing the swap fees earned by LPs.

Those on the Savings Account side, whether depositing directly on DeltaPrime or through Yield Yak instead, would see increased borrowing demand as well, raising the yield earned on their supplied assets. This would most likely have the largest impact on $AVAX due to the nature of the LST pools, with the higher rates for Savings Account deposits attracting more liquidity as well, lowering the rates and encouraging more borrowing again. We've seen similar patterns happen previously when particularly high yielding strategies become available or popular, with some great earnings for those participating.

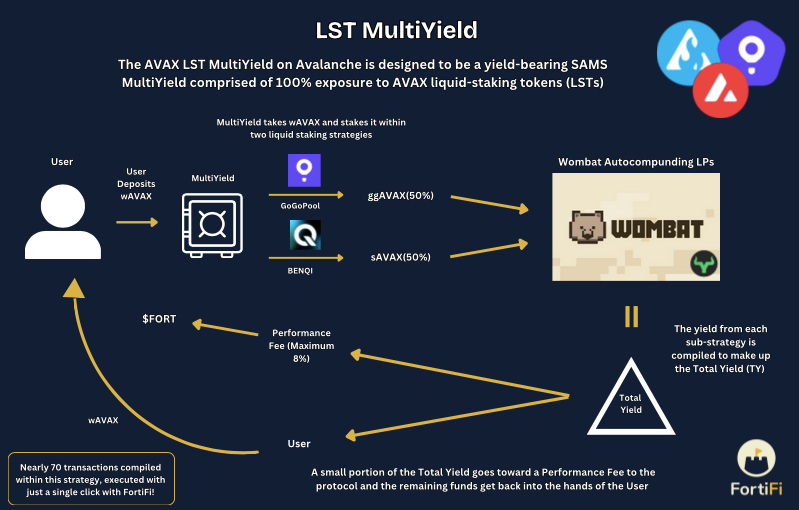

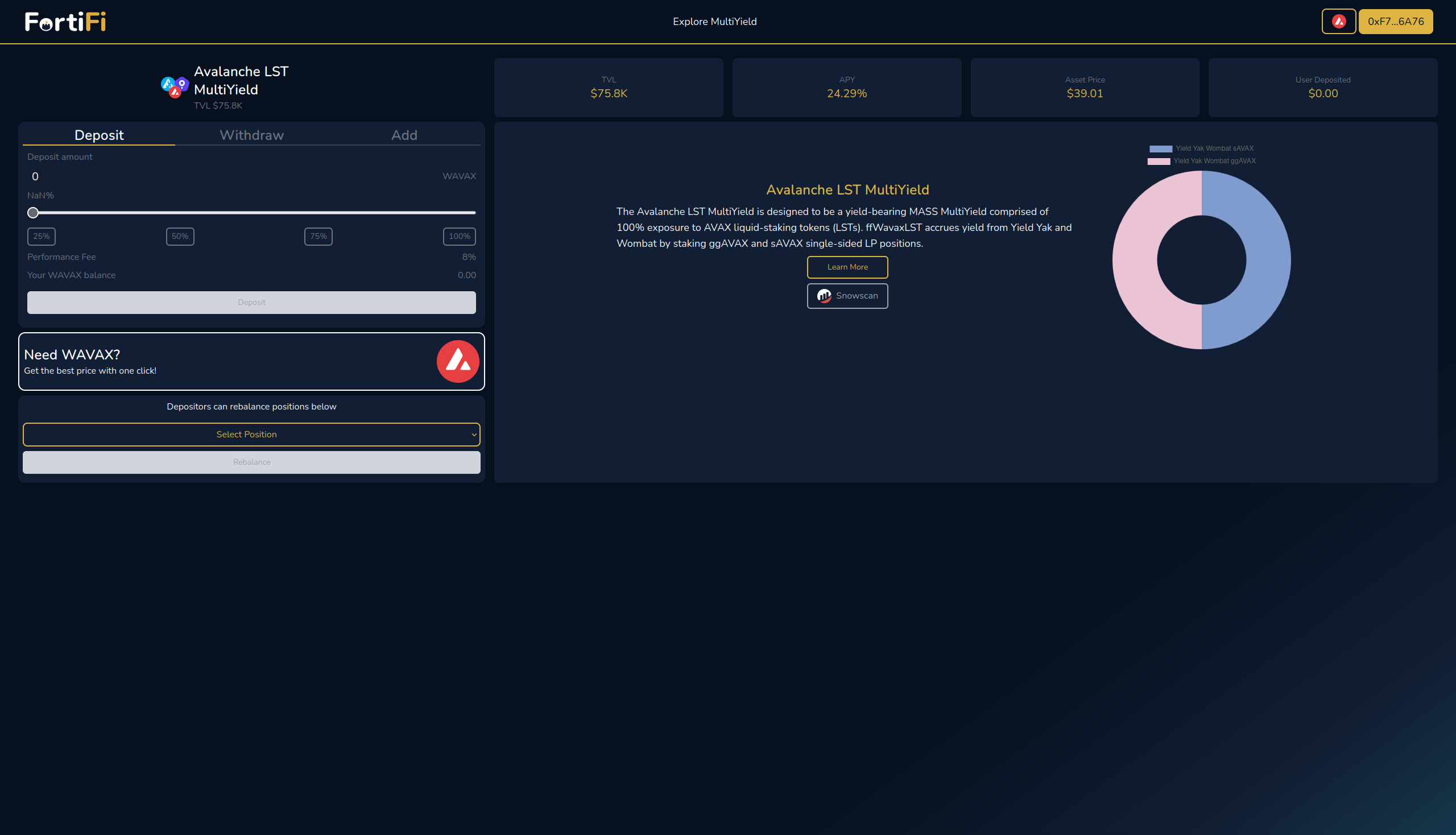

Whilst I keep dreaming about the day that we might see these boosted LST pools on DeltaPrime, the team at FortiFi have been hard at work building on top of them. They just launched over the weekend, with a Stability and LST MultiYield available from the outset.

I really love the MultiYield approach, as I've had something similar in mind for quite a while now, so I personally think it's fantastic to see these options live and available on Avalanche today. Similar thoughts have been echoed by the Yield Yak Treasury, having made an investment prior to FortiFi's launch back in 2023.

The LST MultiYield works by aggregating the yield from the $sAVAX and $ggAVAX pools, splitting deposits equally between the two. This ensures that liquidity is provided to both, benefitting traders of either with lower slippage and better pricing and it increases.

Those looking to maximise their yield in as much of a "set and forget" manner as possible should benefit from this too. Since the rewards for each of the pools on Wombat are variable based on factors such quantity of pooled assets, it means that one of the $sAVAX or $ggAVAX pools usually offers a higher rate than the other. This can result in depositors to the lower yielding pool switching to the higher yielding one for the increased earnings, and can turn the tables on the rates if enough people do so.

The LST MultiYield removes the need for this, as by providing equal amounts of liquidity to both, depositors will always have exposure to the higher yielding pool if the rate for one does exceed that of the other. Whilst the headline APY for this may be lower than ensuring that you're always fully allocated to the best earning pool, there are costs incurred when switching between them, which can start to erode some of that higher figure, particularly if the rates change often enough.

This comes in the form of withdrawal fees based on the coverage ratio of each pool, as mentioned towards the end of my projections. I'd suggest reading Wombat's documentation on this subject at the link above for a full explanation, but a very basic summary is that higher fees are charged on withdrawals of assets the further the ratio deviates from 1, or the more imbalanced the pool is.

Given the current rates and ratios for the $sAVAX and $ggAVAX pools, the fees are quickly negated as the earnings will more than cover them in a short amount of time. They can be offset by deposit gains as well, through which a bonus is paid on deposits, with the amount increasing the more underweight that asset is in the pool. Despite this, I think it's important to consider before depositing as both rates and ratios will change over time, so whilst the impact may be minimal now, it could be larger in the future if you believe that the pool may end up skewed towards one asset over the other.

One of the main attractions of the Yield Yak pools over staking LP positions with Wombat directly is the increased yields they offer, made possible by the 344,827 WOM purchased by the Yield Yak Treasury and locked for the maximum $veWOM boost. This provides a significant uplift to the rewards earned on deposits, which are then compounded back into more of the underlying assets.

I touched on this in my projections as well, but one factor in the impact that the $veWOM boost has is the quantity of the assets in each pool. As Yield Yak receives more deposits, this will gradually be reduced. Another factor is the amount of $veWOM accrued relative to the total supply, which can be seen to be consistently growing in the screenshot from Wombat Analytics just above.

Currently, the strategy implemented by Yield Yak compounds all the rewards earned on deposits, which includes the $WOM distributed to each pool. However, the implementation has been done in such a way that it is possible to enable the collection of the $WOM rewards in the future, rather than compounding them, to allow for them to be used to increase the $weVOM balance. This, in turn, would then further boost the base rates received on each of the implemented pools.

There's no decision on when or whether this may even be enabled, as compounding all rewards provides a more than sufficient boost at the moment, but I think it'll be really interesting to hear thoughts on this in time, once the pools have received more deposits and we've seen what sort of impact they have on the yields.

Overall, I'm extremely impressed with all of the four pools covered in this article, and can already see my positions growing on DeBank, despite only very recently depositing to each of them.

The entire process is really quite straightforward and easy to follow, particularly if you've used similar or any of the named protocols previously, and doesn't take long at all. The yields for doing so are truly incredible at the moment as well. Whilst I don't expect them to stay quite so high once more deposits start to roll in, I do think that they will continue to perform exceptionally well, and am looking forward to coming back to review in the future, and see whether this assumption holds up.

I'm also very curious as to what adoption of Wombat will look like in a few months, for example, as liquidity continues to grow. With it already being such a popular route for trades through aggregators, I'm expecting volume to only increase as TVL does, since it should then be able to facilitate the larger swaps currently routed elsewhere due to the limits of current liquidity levels.

Future integrations and developments will be interesting to see as well. As mentioned earlier, I really hope that DeltaPrime is one of these upcoming integrations. I say it pretty much every time I mention them, but it is one of my favourite protocols across all DeFi, and the earning potential for strategies built using the boosted Yield Yak pools is incredible.

Wombat themselves have plans in the works as well, such as the gamified bribe market for introduced in the first article above, which will see Wombat 2.0 ushered in upon release. These ideas are expanded in the second article, and may see Yield Yak have to adapt the current strategy to accommodate the new changes.

There are also several protocols boosting Wombat yield on other chains, such as Magpie and Wombex, but Yield Yak is currently the only one available on Avalanche. I'm very interested in seeing whether this remains the case, and comparing differences in approach and strategy if not.

Finally, thanks for reading!

To keep up to date with my latest strategies, articles and reviews then you can follow me on any of the below:

As well as news and updates relating to Yield Yak, I'll be sharing new strategies and reviews of existing ones using the protocol on the Yield Yak Content Hub, which you can freely subscribe to if you'd like to receive them directly to your inbox:

You can also find all the protocols, projects and teams mentioned in this article at the following links: