FortiFi Launches MultiYield AVAX and Stability Vaults Built on Top of Yield Yak

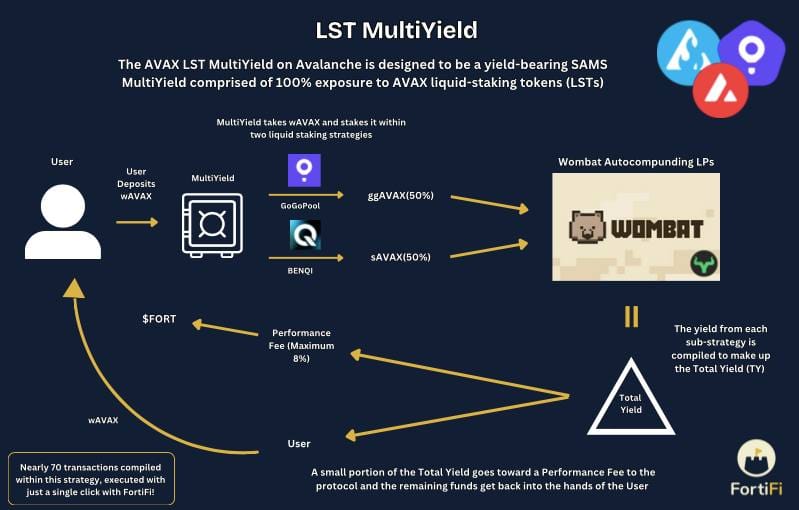

The Avalanche LST MultiYield provides exposure to sAVAX and ggAVAX, aggregating both the inherent staking yields and the rewards from the underlying Wombat LP positions, which are further boosted and compounded by Yield Yak.

The Avalanche LST MultiYield provides exposure to sAVAX and ggAVAX, aggregating both the inherent staking yields and the rewards from the underlying Wombat LP positions, which are further boosted and compounded by Yield Yak.

Introduction

Today's article will be taking a look at FortiFi, who very recently launched on Avalanche, kicking things off with a Stabiliy and LST MultiYield. These take single sided deposits and offer diverse exposure to multiple assets and underlying sources of yield.

The Avalanche LST MultiYield, which is the one I'll be walking through today, works by doing the following:

- Splits deposits equally between $sAVAX and $ggAVAX.

- Supplies both to the relevant liquidity pools on Wombat.

- Deposits the LP tokens to the boosted farms on Yield Yak.

Since the above is all executed with just one click, it provides an extremely easy way to a high yielding and relatively complex strategy, but with the complexity almost entirely abstracted away.

FortiFi

MultiYield may be new to Avalanche, but the team building FortiFi are not, having been active members of the community and working on various projects on the chain for the last few years.

The idea behind it has been in development for quite a while as well, with an article introducing what would eventually be launched as MultiYield first published in August of last year, which you read at the link just above.

There have been a few tweaks to it and iterations between then and now, but the core concepts remain the same, and essentially boil down to the following:

- Making DeFi more accessible, with single sided deposits, in-kind yield and one click execution of the underlying strategies.

- Mitigating single asset exposure, by distributing deposits between multiple assets and then using these to earn from multiple sources of yield.

- Providing higher than average yields, with rewards for the underlying positions boosted and automatically compounded by Yield Yak, resulting in the overall rate being an aggregate of each source.

This is probably best demonstrated with an example, as provided by the image above, explaining exactly what happens when a deposit is made to the Avalanche LST MultiYield. To expand on this a little:

- A single asset, $WAVAX, is deposited with just one click, automating the almost 70 transactions that would otherwise be required to manually replicate the same position.

- An equal amount of $WAVAX is staked with BENQI for $sAVAX and GoGoPool for $ggAVAX, providing exposure to both and the yield each earns against $AVAX.

- The LSTs are provided as liquidity on Wombat, with each earning $WOM rewards. Additional rewards are earned in the form of $QI for the $sAVAX liquidity and $GGP for the $ggAVAX liquidity. Both earn a portion of swap fees as well.

- The LP tokens are deposited to Yield Yak, where the $WOM, $QI and $GGP rewards are all earned at a boosted rate and regularly exchanged into more $sAVAX and $ggAVAX, which is then compounded by adding it to the existing LP positions.

This grows the value of MultiYield deposits against the $WAVAX originally deposited through the combination of the LST yield, the rewards and the fees earned from the LP positions, and both the increased reward rate and impact of compound interest provided by Yield Yak.

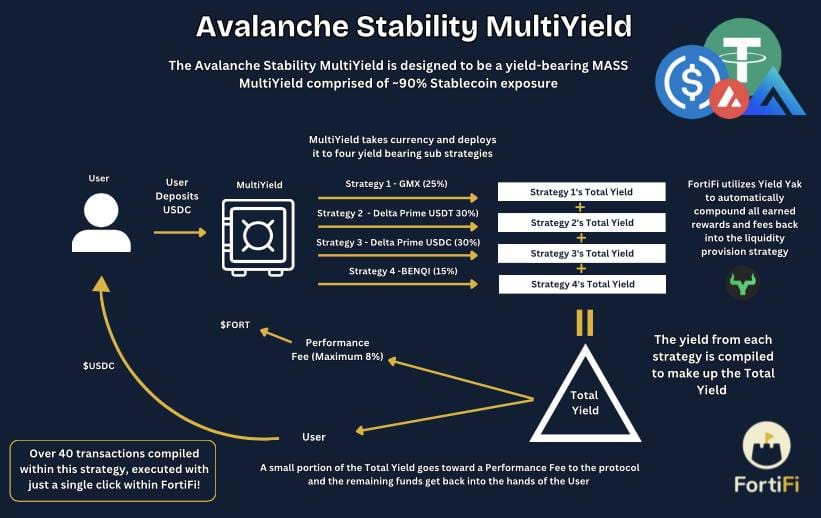

The Stability MultiYield works in a similar fashion, but with a focus on stablecoin exposure and yield, rather than LSTs. The part of this approach that I find particularly interesting is the 25% allocation to the GMX strategy, meaning that there is some limited exposure to volatile assets as well.

There's a detailed explanation of this strategy and the exposure it opens depositors up to in the above page of the FortiFi documentation, if you'd like a better understanding. The reason that this interests me so much is that staking or further utilising $GLP has consistently been a part of several of my personal favourite and higher yielding strategies, such as the two in my latest review from earlier this month.

As a result, and in conjunction with the other three strategies executed by the Stability MultiYield, the total yield is again higher than most similar options that I've come across before, with its APY sitting above 40% since launch.

Wallets

I set up a new wallet with the following address for use with this strategy:

- 0x5D018732B2aEdcb95807BD06AA60058509953eaa

Which you can track, follow and verify on DeBank, SnowTrace and SnowScan:

I then sent 10.5 AVAX to this address, with 10 AVAX to be used for the LST MultiYield deposit and the remaining 0.5 AVAX for gas fees.

This is larger amount reserved for gas than I'd normally use, because I actually made a previous deposit to the MultiYield a few days ago and the transaction is quite a bit more expensive than most. So I wanted to make sure that I had more than enough allocated to cover the fees today.

Entering the LST MultiYield

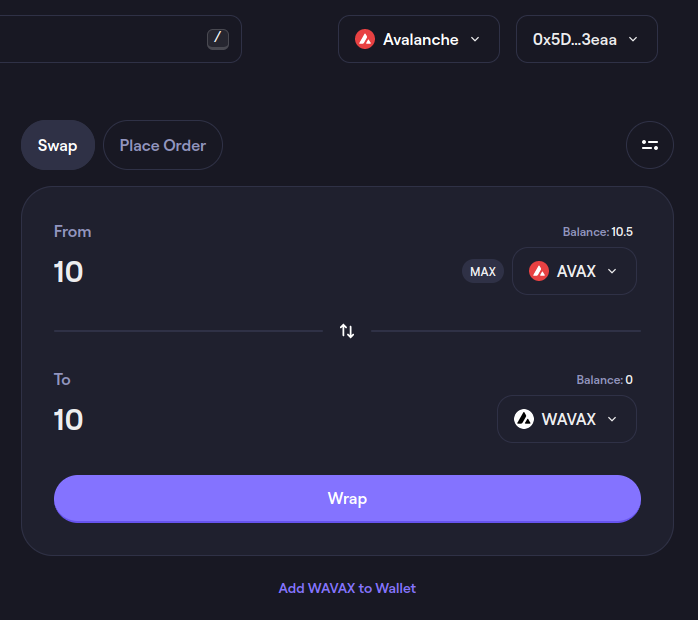

FortiFi accepts $WAVAX rather than native $AVAX for deposits to the LST MultiYield, so the first thing I had to do was wrap the 10 AVAX that I wanted to deposit. I usually use Trader Joe for this, as it calls the $WAVAX contract directly and provides a familiar UI for doing so.

To complete the wrapping process, I simply selected $AVAX to spend, $WAVAX to receive, entered 10 AVAX and pressed the Wrap button that appears in the place of the usual swap one. There's just a single transaction required for this and you receive the exact same quantity of the wrapped asset, giving me 10 WAVAX in return.

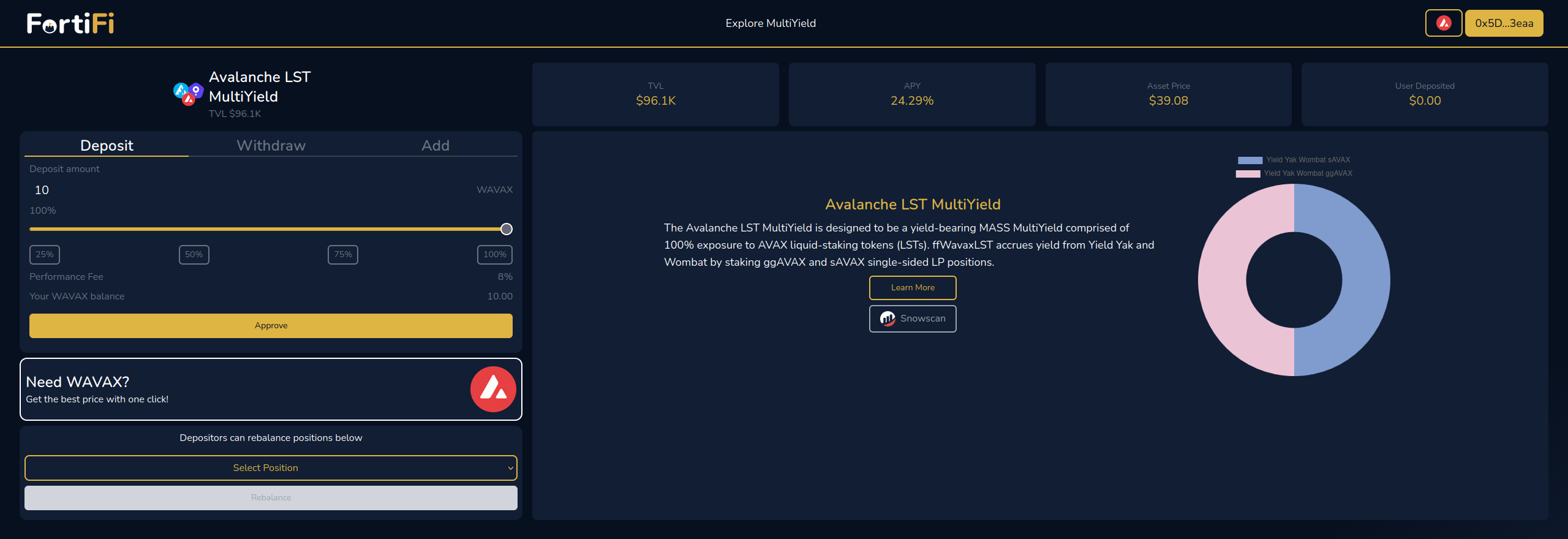

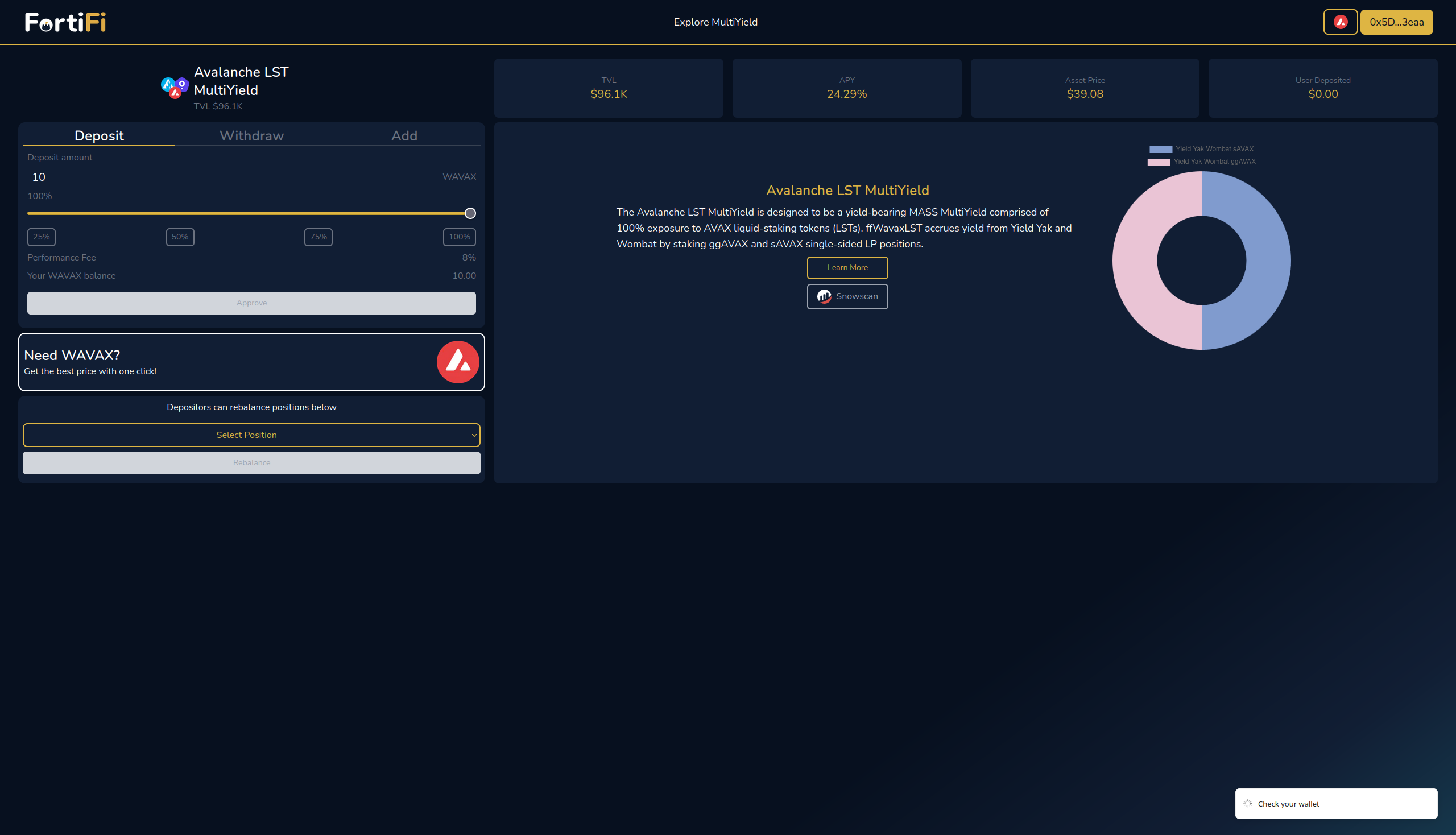

Next, I visited FortiFi and pressed the Explore MultiYield option in the menu bar along the top of the page, which took me to the list in the screenshot above, and then selected the Avalanche LST MultiYield option highlighted.

Once on the LST MultiYield page, I pressed the 100% button to select my full 10 WAVAX balance to deposit and pressed the Approve button just underneath to proceed.

This required one transaction for the approval and notified me once this was confirmed, displaying the message in the bottom-right corner of the screenshot above. I was then automatically prompted to confirm the deposit itself, which required one final transaction to complete.

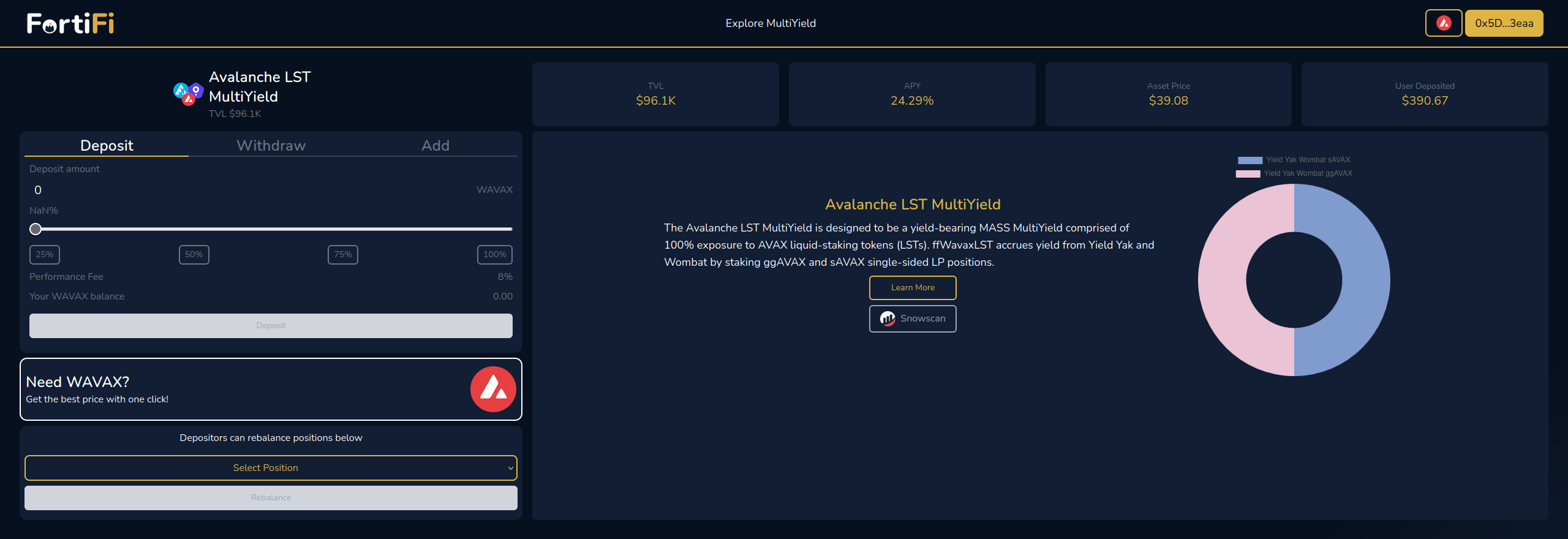

After the final transaction was confirmed, the page automatically updated to display the value of my deposit in the User Deposited box towards the top-right of the page, with the total coming to $390.64 for my 10 WAVAX deposit.

And that was it! My deposit was completed successfully and was already earning yield for me at a rate of 24.29% APY in a just two transactions, or three in all if you include the initial wrapping as well. As mentioned previously, FortiFi really have made this an incredibly simple and easy to follow process.

I also mentioned that the deposit transaction is more expensive than most, after going through the process separately prior to today. This still applies, with 0.3145922 AVAX of the 0.5 AVAX that I originally reserved for gas left after completing the process again today, meaning that I spent a total of 0.1854078 AVAX on gas fees.

Almost the entirety of this was spent on the deposit, costing 0.183131175 AVAX by itself. In comparison, the just 0.00227662 AVAX in total was spent on gas for both the wrapping and approval transactions combined.

Projections

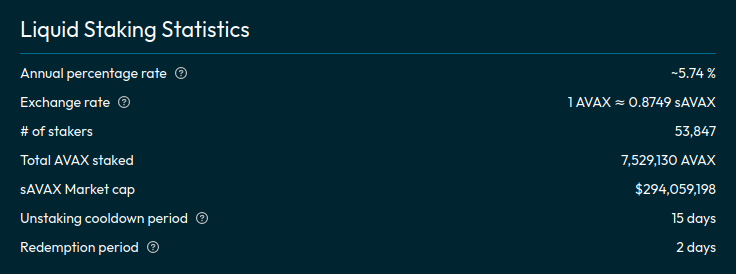

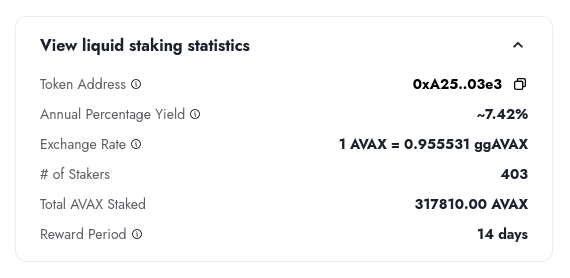

The Avalanche LST MultiYield is estimating an APY of 24.29% at the moment, however this doesn't include the underlying liquid staking yield. For $sAVAX, there's an estimated APR of 5.74% from BENQI currently.

The estimated rate for $ggAVAX is a little higher, with an estimated APY of 7.42% being provided by GoGoPool. Since the LST MultiYield deposits are split evenly between the two, this gives us a rate of around 6.58% APY overall for the liquid staking yield.

Combining all of the above gives us a total APY of 30.87% for the strategy. Making the assumption that this remains the same for the duration, then I can expect to earn the following on my initial 10 AVAX deposit:

- 1 week - 0.0593653846 AVAX

- 1 month - 0.25725 AVAX

- 1 year - 3.087 AVAX

There are several things to keep in mind when looking at these estimates, which are covered in the Other Considerations section of the article above, found just under the projections made there.

The same things apply in this instance, since the LST MultiYield is using two of the same four farms for earning yield, with the main difference being that this approach offers aggregated exposure to both rather than just one of the two, or having to deposit to and maintain two separate positions.

Conclusion

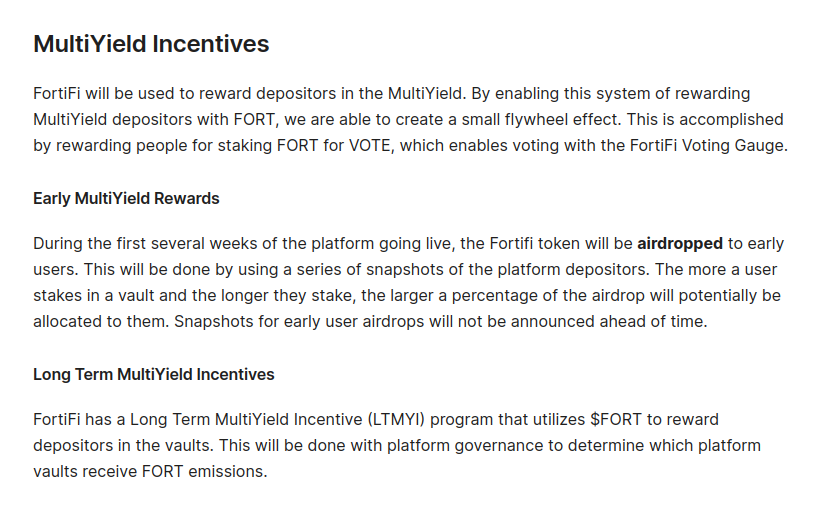

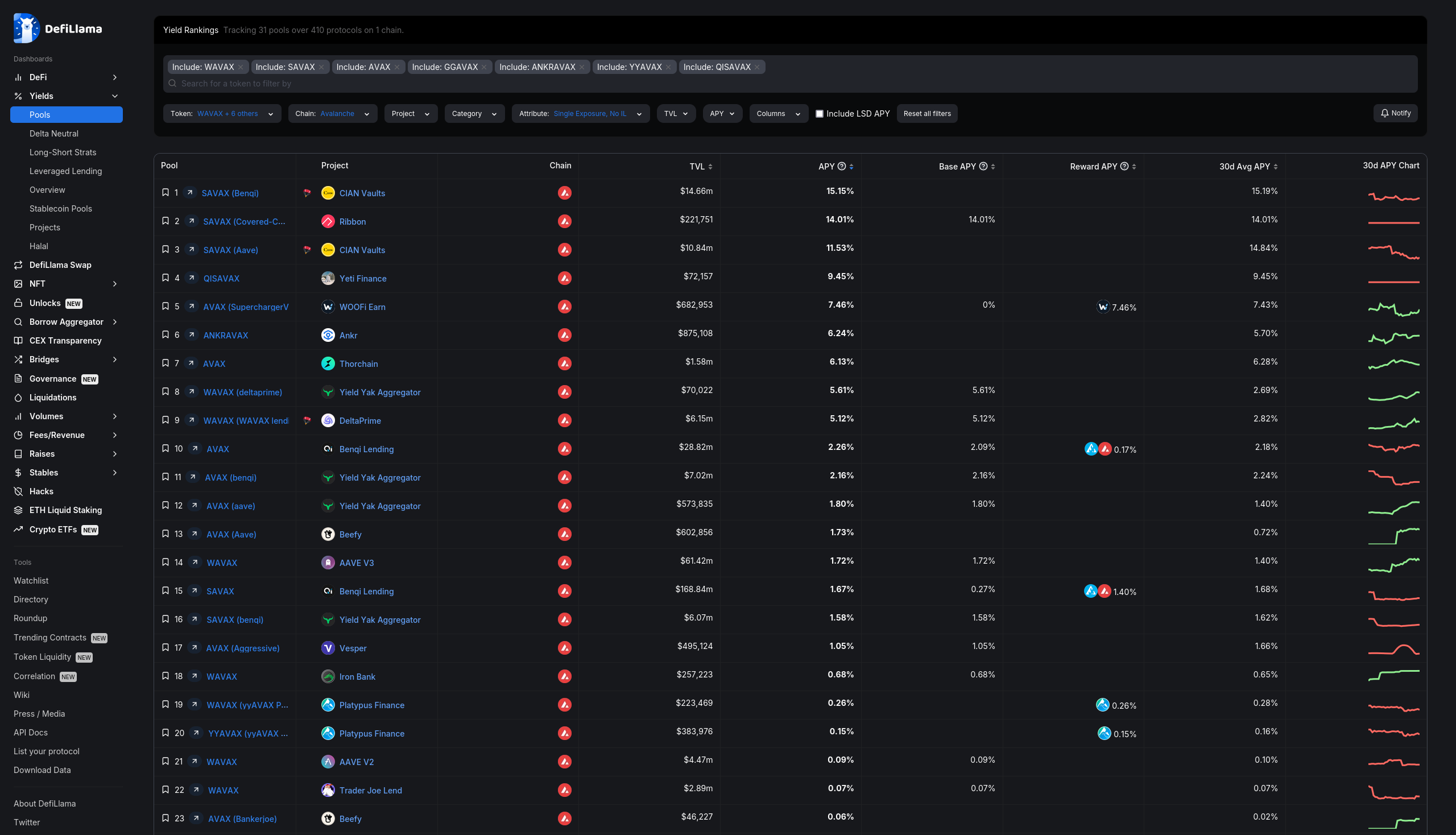

One added bonus of using FortiFi and depositing to the LST or Stability MultiYield is that you will then be eligible for additional incentives, on top of the yield that each already offers. The incentives will come in the form of $FORT, the protocol's native token, distributed via airdrops for early users, and as emissions decided through a governance process for the long term program.

I think that this presents an excellent opportunity for early users looking to earn with the MultiYield strategies and participate in the airdrops. There's more information available on the FortiFi Token page of the documentation, but at such an early stage I think that any deposit made now is likely to form a much larger percentage of the total, working under the assumption that TVL will continue to grow. As such, a deposit made today could qualify for a more substantial airdrop allocation than one of the same size made in a month or two instead, for example.

Regardless, this shouldn't be your main focus if considering depositing. I didn't include the airdrops or long term incentives in my projections for similar reasons as my in my article on Poolside above, as any attempts to do so would be pure speculation and guesswork on my part.

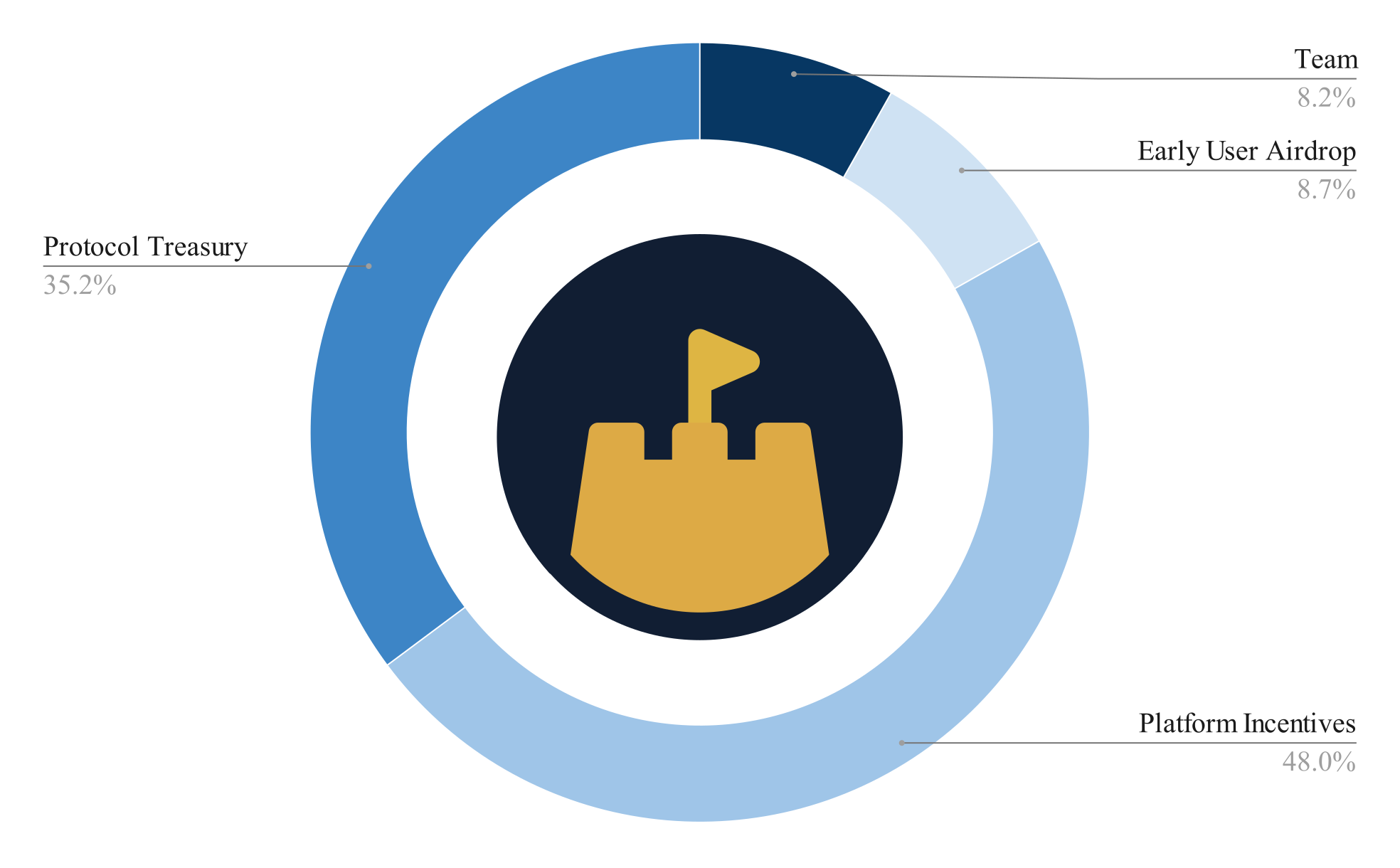

Despite this, the current estimates for the Avalanche LST MultYield would place it at the top of comparable options listed on DefiLlama, in terms of yield. However this doesn't currently list the boosted Yield Yak farms used by the underlying strategies. If one of these has a higher rate than the other, then that one would always come above the MultiYield approach, which would itself come above the lower yielding one. This is a result of the aggregated exposure to both, meaning that the MultiYield will always sit in between the two by yielding an average of their respective rates.

Overall, I was really impressed by my experience with FortiFi. The Avalanche LST MultiYield offers amongst the best yields available on $AVAX available at moment. The deposit process is about as simple as it gets, but I do think could be slightly streamlined by allowing deposits of native rather than wrapped $AVAX, and executing the wrapping process in the deposit step.

I am hoping that DeBank add support for FortiFi MultiYield soon though, since I often use it to track the current balances and accrued rewards for some of my different wallets, and it's a little disconcerting to see my deposit arrive and then seemingly vanish shortly afterwards.

Finally, thanks for reading!

To keep up to date with my latest strategies, articles and reviews then you can follow me on any of the below:

If you'd like to receive Yield Yak updates directly to your inbox, you can freely subscribe to the Content Hub as well:

You can also find all the protocols, projects and teams mentioned in this article at the following links: